Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 4

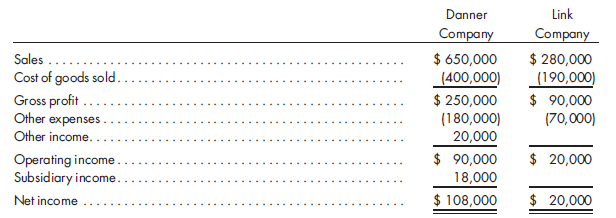

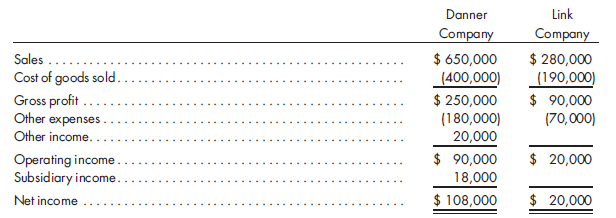

Fixed asset sales by parent and subsidiary. The separate income statements of Danner Company and its 90%-owned subsidiary, Link Company, for the year ended December 31, 2012, are as follows:

a. On January 1, 2011, Link Company purchased a building, with a book value of $100,000 and an estimated 20-year life, from Danner Company for $150,000. The building was being depreciated on a straight-line basis with no salvage value.

b. On January 1, 2012, Link Company sold a machine with a cost of $40,000 to Danner Company for $60,000. The machine had an expected life of five years and is being depreciated on a straight-line basis with no salvage value. Link Company is a dealer for the machine. Prepare a worksheet that shows income statements of Danner and Link with a column for eliminations. Be sure to include the distribution of income to the controlling and non-controlling interest.

a. On January 1, 2011, Link Company purchased a building, with a book value of $100,000 and an estimated 20-year life, from Danner Company for $150,000. The building was being depreciated on a straight-line basis with no salvage value.

b. On January 1, 2012, Link Company sold a machine with a cost of $40,000 to Danner Company for $60,000. The machine had an expected life of five years and is being depreciated on a straight-line basis with no salvage value. Link Company is a dealer for the machine. Prepare a worksheet that shows income statements of Danner and Link with a column for eliminations. Be sure to include the distribution of income to the controlling and non-controlling interest.

Explanation

It is calculated that adjusted income of...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255