Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 6

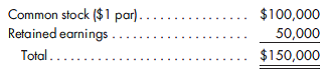

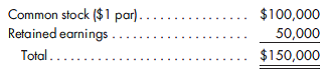

100%, cost, merchandise sales, percentage-of-completion contracts. Pardon, Inc., purchased 100% of the common stock of Slarno Corporation for $150,000 in cash on June 30, 2011. At that date, Slarno's stockholders' equity was as follows:

The fair values of the assets and liabilities did not differ materially from their book values. Slarno made no adjustments on its books to reflect the purchase by Pardon. On December 31, 2011, Pardon and Slarno prepared consolidated financial statements.

The transactions that occurred between Pardon and Slarno during the next year included

the following:

a. On January 3, 2012, land with a $10,000 book value was sold by Pardon to Slarno for $15,000. Slarno made a $3,000 down payment and signed an 8% mortgage note, payable in12 equal quarterly payments of $1,135, including interest, beginningMarch 31, 2012.

b. Slarno produced equipment for Pardon under two separate contracts. The first contract, which was for office equipment, was begun and completed during the year at a cost to Slarno of $17,500. Pardon paid $22,000 in cash for the equipment on April 17, 2012. The second contract was begun on February 15, 2012, but will not be completed untilMay 2013. Slarno incurred $45,000 of costs as of December 31, 2012, and anticipated an additional $30,000 of costs to complete the $95,000 contract. Slarno accounts for all contracts under the percentage- of-completion method. Pardon has made no account on its books for this uncompleted contract as of December 31, 2012.

c. Pardon depreciates all of its equipment over a 10-year estimated economic life, with no salvage value. Pardon takes one-half-year's depreciation in the year of purchase.

d. Pardon sold merchandise to Slarno at an average markup of 12% on cost. During the year, Pardon charged Slarno $238,000 for merchandise purchased, of which Slarno paid $211,000. Slarno had $11,200 of this merchandise on hand on December 31, 2012.

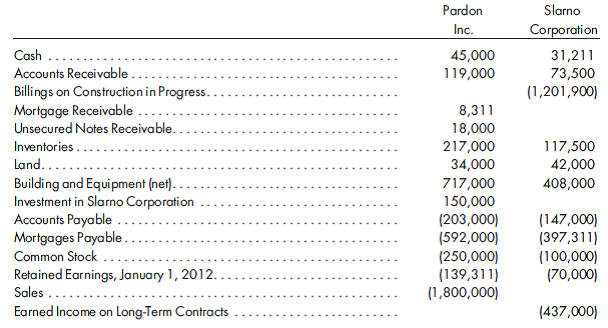

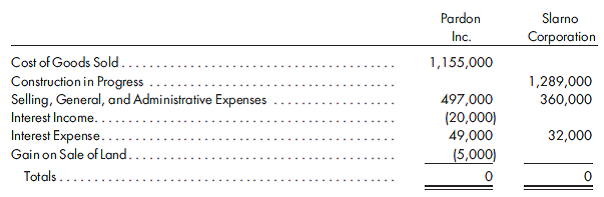

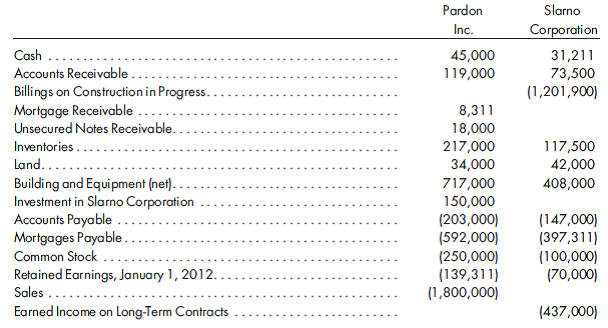

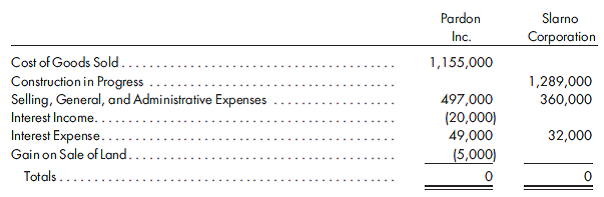

Trial balances of Pardon Inc. and its subsidiary as of December 31, 2012, were as follows:

Prepare the worksheet necessary to produce the consolidated financial statements of Pardon Inc., and its subsidiary for the year ended December 31, 2012. Assume both companies have made all the adjusting entries required for separate financial statements unless an obvious discrepancy exists. Include the determination and distribution of excess schedule.

The fair values of the assets and liabilities did not differ materially from their book values. Slarno made no adjustments on its books to reflect the purchase by Pardon. On December 31, 2011, Pardon and Slarno prepared consolidated financial statements.

The transactions that occurred between Pardon and Slarno during the next year included

the following:

a. On January 3, 2012, land with a $10,000 book value was sold by Pardon to Slarno for $15,000. Slarno made a $3,000 down payment and signed an 8% mortgage note, payable in12 equal quarterly payments of $1,135, including interest, beginningMarch 31, 2012.

b. Slarno produced equipment for Pardon under two separate contracts. The first contract, which was for office equipment, was begun and completed during the year at a cost to Slarno of $17,500. Pardon paid $22,000 in cash for the equipment on April 17, 2012. The second contract was begun on February 15, 2012, but will not be completed untilMay 2013. Slarno incurred $45,000 of costs as of December 31, 2012, and anticipated an additional $30,000 of costs to complete the $95,000 contract. Slarno accounts for all contracts under the percentage- of-completion method. Pardon has made no account on its books for this uncompleted contract as of December 31, 2012.

c. Pardon depreciates all of its equipment over a 10-year estimated economic life, with no salvage value. Pardon takes one-half-year's depreciation in the year of purchase.

d. Pardon sold merchandise to Slarno at an average markup of 12% on cost. During the year, Pardon charged Slarno $238,000 for merchandise purchased, of which Slarno paid $211,000. Slarno had $11,200 of this merchandise on hand on December 31, 2012.

Trial balances of Pardon Inc. and its subsidiary as of December 31, 2012, were as follows:

Prepare the worksheet necessary to produce the consolidated financial statements of Pardon Inc., and its subsidiary for the year ended December 31, 2012. Assume both companies have made all the adjusting entries required for separate financial statements unless an obvious discrepancy exists. Include the determination and distribution of excess schedule.

Explanation

Determination and distribution of excess...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255