Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 3

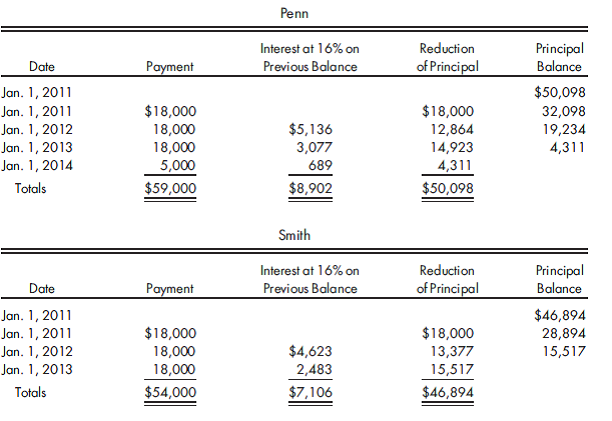

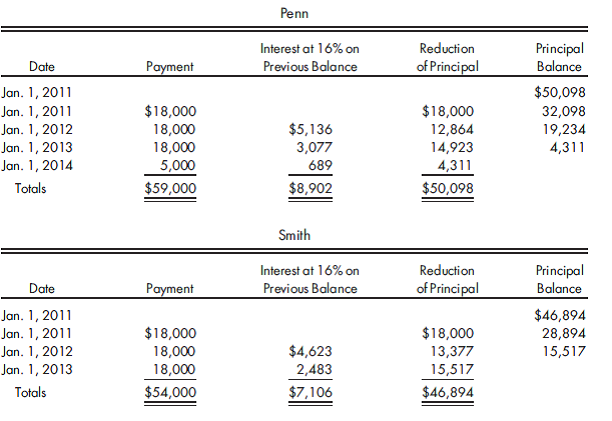

Eliminations only, sales-type lease with unguaranteed residual value. Penn Company leased a production machine to its 80%-owned subsidiary, Smith Company. The lease agreement, dated January 1, 2011, requires Smith to pay $18,000 each January 1 for three years. There is an unguaranteed residual value of $5,000. The machine cost $50,098. The present value of the machine at Penn's 16% implicit interest rate was $50,098 on

January 1, 2011. Smith also uses the 16% lessor implicit rate to record the lease. The machine is being depreciated over three years on a straight-line basis with a $5,000 salvage value. Lease payment amortization schedules are as follows:

1. Prepare the eliminations and adjustments required for this lease on the December 31, 2011, consolidated worksheet.

2. Prepare the eliminations and adjustments for the December 31, 2012, consolidated worksheet.

January 1, 2011. Smith also uses the 16% lessor implicit rate to record the lease. The machine is being depreciated over three years on a straight-line basis with a $5,000 salvage value. Lease payment amortization schedules are as follows:

1. Prepare the eliminations and adjustments required for this lease on the December 31, 2011, consolidated worksheet.

2. Prepare the eliminations and adjustments for the December 31, 2012, consolidated worksheet.

Explanation

Eliminations and Adjustments at December...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255