Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 9

Cost method, 90%, straight-line bonds. On January 1, 2011, Patrick Company acquired 90% of the common stock of Stunt Company for $351,000. On this date, Stunt had common stock, other paid-in capital in excess of par, and retained earnings of $100,000, $40,000, and $210,000, respectively. The excess of cost over book value is due to goodwill. In both 2011 and 2012, Patrick accounted for the investment in Stunt using the cost method.

On January 1, 2011, Stunt sold $100,000 par value of 10-year, 8% bonds for $94,000. The bonds pay interest semiannually on January 1 and July 1 of each year. On December 31, 2011, Patrick purchased all of Stunt's bonds for $96,400. The bonds are still held on December 31, 2012. Both companies correctly recorded all entries relative to bonds and interest, using straight-line amortization for premium or discount.

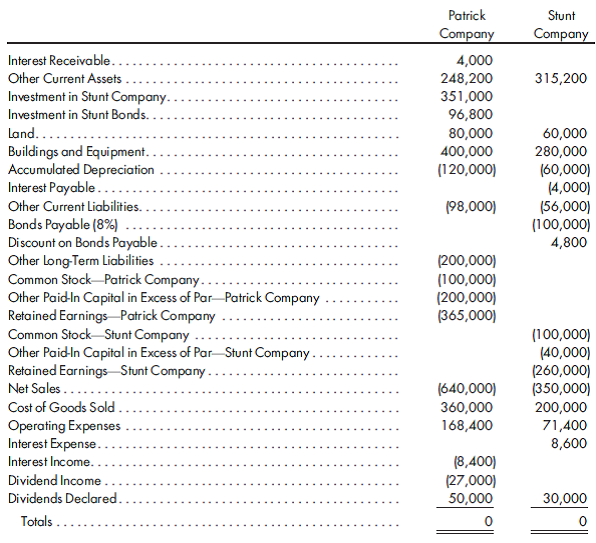

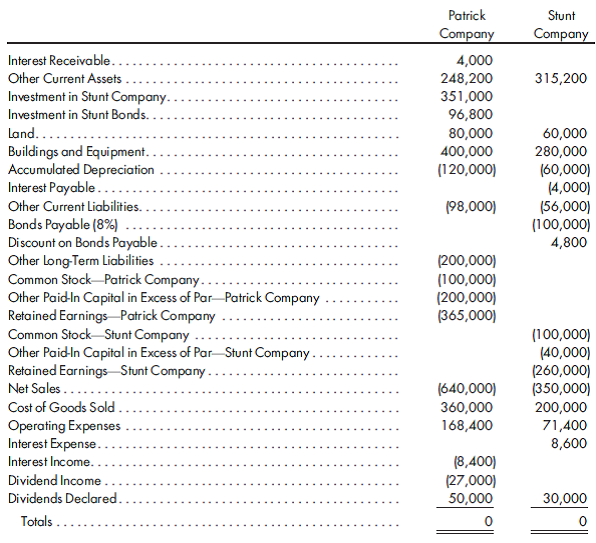

The trial balances of Patrick Company and its subsidiary were as follows on December 31, 2012:

Prepare the worksheet necessary to produce the consolidated financial statements of Patrick and its subsidiary Stunt for the year ended December 31, 2012. Round all computations to the nearest dollar.

On January 1, 2011, Stunt sold $100,000 par value of 10-year, 8% bonds for $94,000. The bonds pay interest semiannually on January 1 and July 1 of each year. On December 31, 2011, Patrick purchased all of Stunt's bonds for $96,400. The bonds are still held on December 31, 2012. Both companies correctly recorded all entries relative to bonds and interest, using straight-line amortization for premium or discount.

The trial balances of Patrick Company and its subsidiary were as follows on December 31, 2012:

Prepare the worksheet necessary to produce the consolidated financial statements of Patrick and its subsidiary Stunt for the year ended December 31, 2012. Round all computations to the nearest dollar.

Explanation

It is given that the internally generate...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255