Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 32

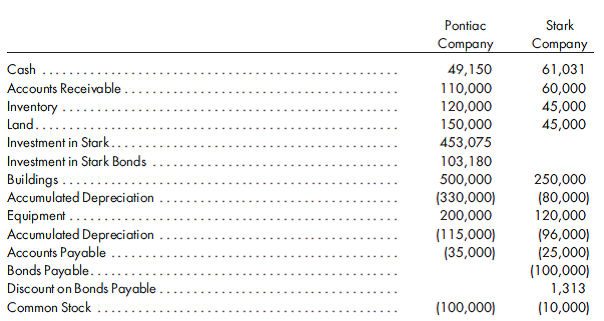

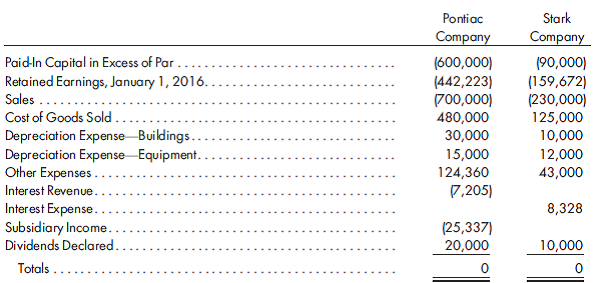

80%, equity, straight-line bonds purchased last year, inventory profits. Refer to the preceding facts for Pontiac's acquisition of 80% of Stark's common stock and the bond transactions. Pontiac uses the simple equity method to account for its investment in Stark. On January 1, 2016, Stark held merchandise acquired from Pontiac for $20,000. During 2016, Pontiac sold $60,000 worth of merchandise to Stark. Stark held $25,000 of this merchandise at December 31, 2016. Stark owed Pontiac $12,000 on December 31 as a result of these intercompany sales. Pontiac has a gross profit rate of 30%. Pontiac and Stark had the following trial balances on December 31, 2016:

Prepare the worksheet necessary to produce the consolidated financial statements for Pontiac Company and its subsidiary Stark Company for the year ended December 31, 2016. Include the determination and distribution of excess and income distribution schedules.

Prepare the worksheet necessary to produce the consolidated financial statements for Pontiac Company and its subsidiary Stark Company for the year ended December 31, 2016. Include the determination and distribution of excess and income distribution schedules.

Explanation

Consolidated financial statement:

A fin...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255