Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 16

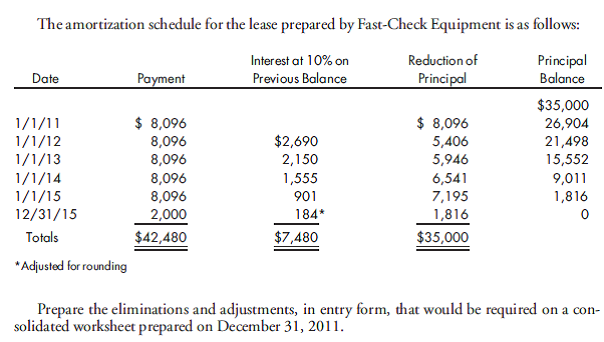

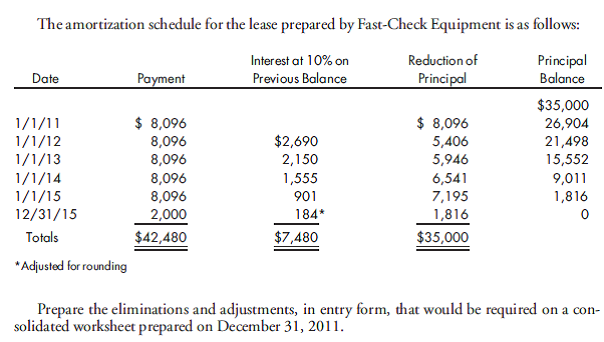

Sales-type lease eliminations. The Auto Clinic is a wholly owned subsidiary of Fast-Check Equipment Company. Fast-Check Equipment sells and leases 4-wheel alignment machines. The usual selling price of each machine is $35,000; it has a cost to Fast- Check Equipment of $25,000. On January 1, 2011, Fast-Check Equipment leased such a machine to Auto Clinic. The lease provided for payments of $9,096 at the start of each year for five years. The payments include $1,000 per year for maintenance to be provided by the seller. There is a bargain purchase price of $2,000 at the end of the fifth year. The implicit interest rate in the lease is 10% per year. The equipment is being depreciated over eight years.

Explanation

• An obligation under capital lease is ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255