Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 1

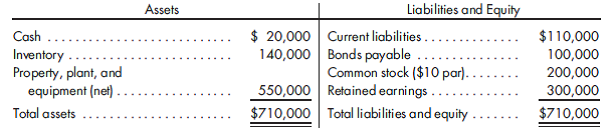

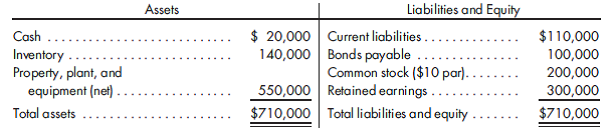

Cash flow, cash payment, year of acquisition. Banner Company acquires an 80% interest in Roller Company for $640,000 cash on January 1, 2013. The NCI has a fair value of $160,000. Any excess of cost over book value is attributed to goodwill. To help pay for the acquisition, Banner Company issues 5,000 shares of its common stock with a fair value of $70 per share. Roller's balance sheet on the date of the purchase is as follows:

Controlling share of net income for 2013 is $150,000, net of the noncontrolling interest of $10,000. Banner declares and pays dividends of $10,000, and Roller declares and pays dividends of $5,000. There are no purchases or sales of property, plant, or equipment during the year. Based on the following information, prepare a statement of cash flows using the indirect method for Banner Company and its subsidiary for the year ended December 31, 2013. Any supporting schedules should be in good form.

Controlling share of net income for 2013 is $150,000, net of the noncontrolling interest of $10,000. Banner declares and pays dividends of $10,000, and Roller declares and pays dividends of $5,000. There are no purchases or sales of property, plant, or equipment during the year. Based on the following information, prepare a statement of cash flows using the indirect method for Banner Company and its subsidiary for the year ended December 31, 2013. Any supporting schedules should be in good form.

Explanation

Calculate consolidated net income.

It is...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255