Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 19

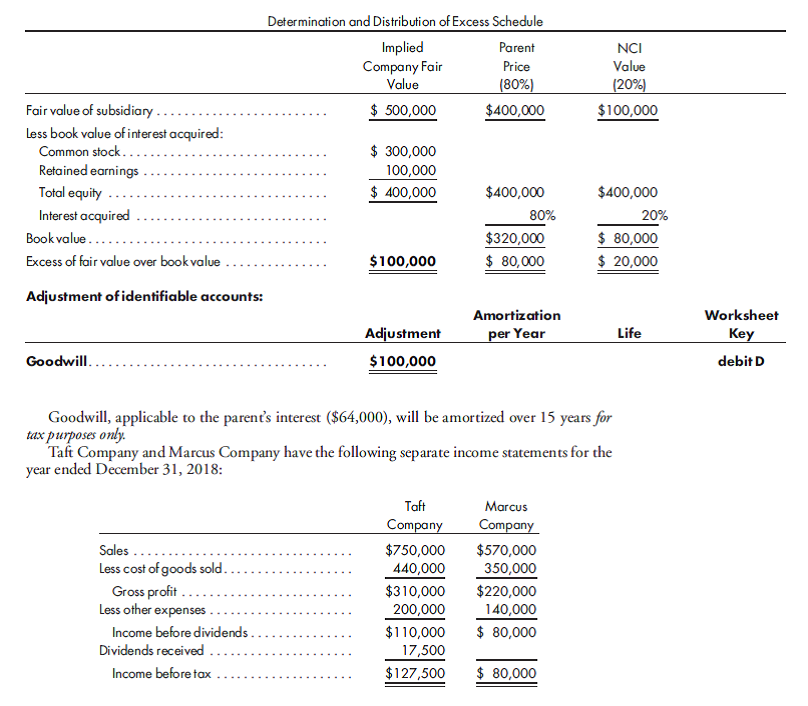

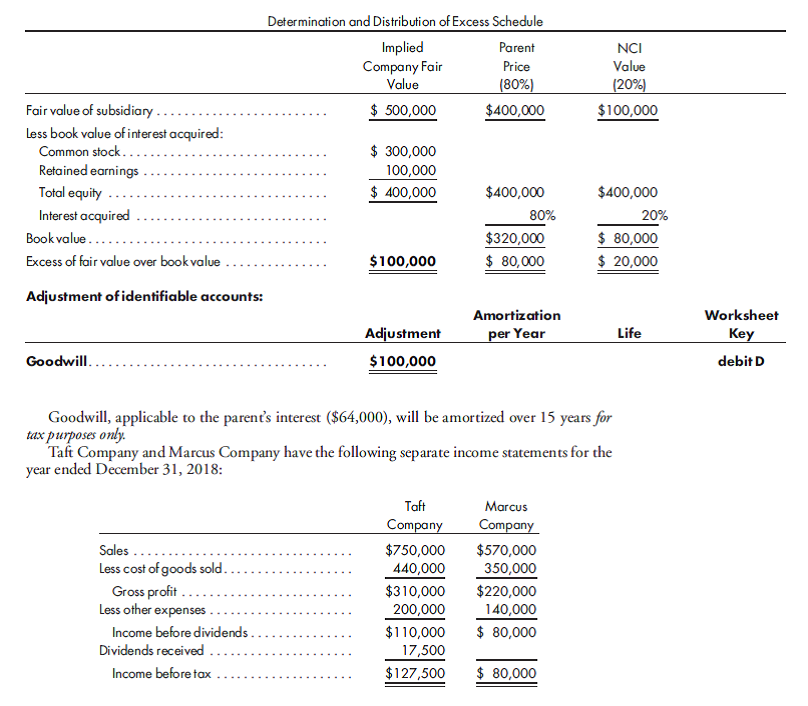

Taxation as consolidated company. On May 1, 2016, Taft Company acquires a 80% interest in Marcus Company for $400,000. The fair value of the NCI is $100,000. The following determination and distribution of excess schedule is prepared:

During 2018,Marcus Company pays cash dividends of $25,000.

Prepare the entry to record income tax payable on each company's books. Assume a 30% corporate income tax rate.

During 2018,Marcus Company pays cash dividends of $25,000.

Prepare the entry to record income tax payable on each company's books. Assume a 30% corporate income tax rate.

Explanation

Journal entry in the books of M company ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255