Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 23

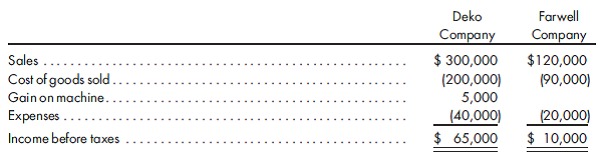

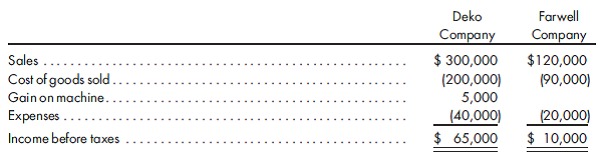

Consolidated taxation, intercompany profits. Deko Company purchases an 80% interest in the common stock of Farwell Company for $850,000 on January 1, 2017. At the time of the purchase, the total stockholders' equity of Farwell is $968,750. The fair value of the NCI is $212,500. The excess of cost over book value is attributed to a patent with a 10-year life. During 2019, Deko Company and Farwell Company report the internally generated income before taxes as shown on page 362.

Farwell Company sells goods to Deko Company for $50,000. Deko Company has $20,000 of Farwell Company's goods in its beginning inventory and $6,000 of Farwell's goods in its ending inventory.

Farwell Company sells goods to Deko Company at a gross profit of 40%.

Deko Company sells a new machine to Farwell Company on January 1, 2019, for $30,000. The machine has a 5-year life, and its cost is $25,000. The affiliated group files a consolidated tax return and is taxed at 30%.

Prepare a determination and distribution of excess schedule and a consolidated income statement for 2019. Include income distribution schedules for both companies.

Farwell Company sells goods to Deko Company for $50,000. Deko Company has $20,000 of Farwell Company's goods in its beginning inventory and $6,000 of Farwell's goods in its ending inventory.

Farwell Company sells goods to Deko Company at a gross profit of 40%.

Deko Company sells a new machine to Farwell Company on January 1, 2019, for $30,000. The machine has a 5-year life, and its cost is $25,000. The affiliated group files a consolidated tax return and is taxed at 30%.

Prepare a determination and distribution of excess schedule and a consolidated income statement for 2019. Include income distribution schedules for both companies.

Explanation

Calculate profit in opening inventory.

I...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255