Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 12

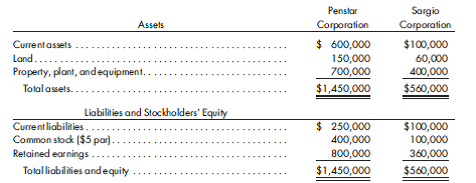

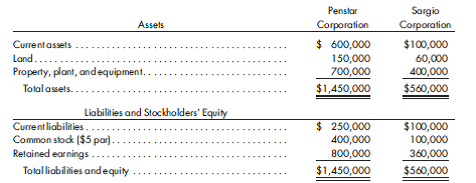

Balance sheet worksheet, blocks, control with first, inventory, fixed asset sales. The December 31, 2019, post-closing trial balances of Marley Corporation and its subsidiary, Foster Corporation, are as follows:

Foster net income is earned ratably during the year.

On December 15, 2019, Foster declares a cash dividend of $4 per share of common stock, payable to shareholders on January 7, 2020.

b. During 2019, Marley sells merchandise to Foster.Marley has a 25% gross profit, and the sale is made at $80,000. Foster's inventory at December 31, 2019, includes merchandise purchased from Marley for $40,000.

c. On October 1, 2019, Marley sells excess equipment to Foster for $45,000. Data relating to this equipment are as follows:

Book value on Marley's records.......................................... $36,000

Method of depreciation................................................. Straight-line

Estimated remaining life on October 1, 2019................................ 10 years

d. Near the end of 2019, Foster reduces the balance of its intercompany account payable to zero by transferring $8,000 toMarley. This payment is still in transit on December 31, 2019.

Prepare the worksheet necessary to produce the consolidated balance sheet of Marley Corporation and its subsidiary as of December 31, 2019. Include an analysis for Marley's purchase of Foster common stock on September 1, 2019.

Foster net income is earned ratably during the year.

On December 15, 2019, Foster declares a cash dividend of $4 per share of common stock, payable to shareholders on January 7, 2020.

b. During 2019, Marley sells merchandise to Foster.Marley has a 25% gross profit, and the sale is made at $80,000. Foster's inventory at December 31, 2019, includes merchandise purchased from Marley for $40,000.

c. On October 1, 2019, Marley sells excess equipment to Foster for $45,000. Data relating to this equipment are as follows:

Book value on Marley's records.......................................... $36,000

Method of depreciation................................................. Straight-line

Estimated remaining life on October 1, 2019................................ 10 years

d. Near the end of 2019, Foster reduces the balance of its intercompany account payable to zero by transferring $8,000 toMarley. This payment is still in transit on December 31, 2019.

Prepare the worksheet necessary to produce the consolidated balance sheet of Marley Corporation and its subsidiary as of December 31, 2019. Include an analysis for Marley's purchase of Foster common stock on September 1, 2019.

Explanation

Calculation of amortization

On October 1...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255