Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 22

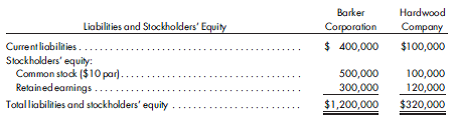

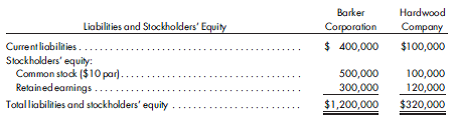

Block purchase, control with first block. Barker Corporation purchases a 60% interest in Hardwood Company on January 1, 2011, for $150,000. On that date, Hardwood Company has the following stockholders' equity:

Prepare a determination and distribution of excess schedule for the January 1, 2011, acquisition and analysis of the 20% acquisition on January 1, 2013. Prepare the consolidated balance sheet of Barker Corporation and subsidiary Hardwood Company on December 31, 2015.

Prepare a determination and distribution of excess schedule for the January 1, 2011, acquisition and analysis of the 20% acquisition on January 1, 2013. Prepare the consolidated balance sheet of Barker Corporation and subsidiary Hardwood Company on December 31, 2015.

Explanation

Subsidiary Company

The company that is ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255