Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 11

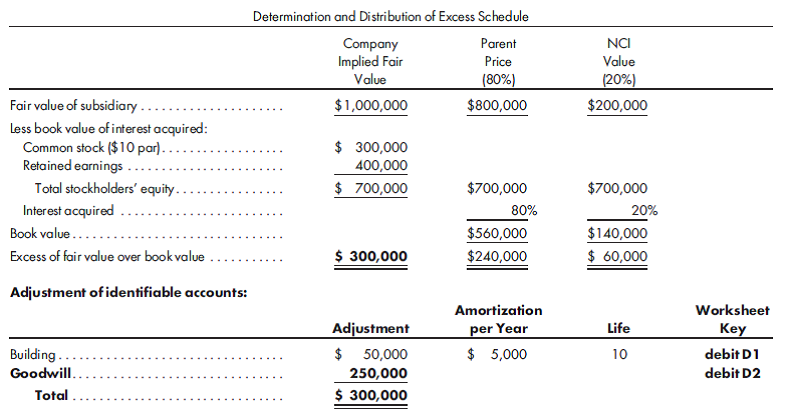

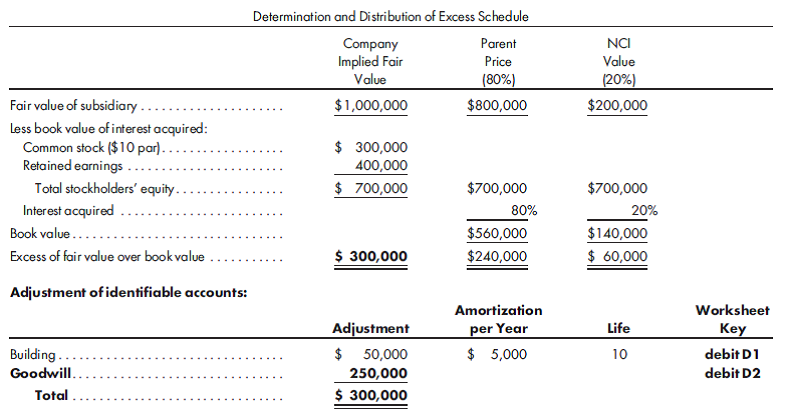

Sale of interest, alternative remaining interests. Center, Inc., purchases 24,000 shares of Bruce Corporation, which equates to an 80% interest, on January 1, 2015. The following determination and distribution of excess schedule is prepared:

Bruce Corporation reports net income of $35,000 for the six months ended July 1, 2018. Center's simple-equity-adjusted investment balance is $864,000 as of December 31, 2017.

Prepare all entries for the sale of the Brown Corporation shares on July 1, 2018, for each of the following situations:

1. 24,000 shares are sold for $890,000.

2. 12,000 shares are sold for $455,000.

3. 6,000 shares are sold for $232,500.

Bruce Corporation reports net income of $35,000 for the six months ended July 1, 2018. Center's simple-equity-adjusted investment balance is $864,000 as of December 31, 2017.

Prepare all entries for the sale of the Brown Corporation shares on July 1, 2018, for each of the following situations:

1. 24,000 shares are sold for $890,000.

2. 12,000 shares are sold for $455,000.

3. 6,000 shares are sold for $232,500.

Explanation

Journal entries for the sale of B corpor...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255