Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 15

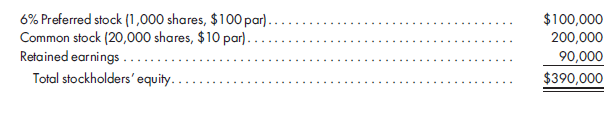

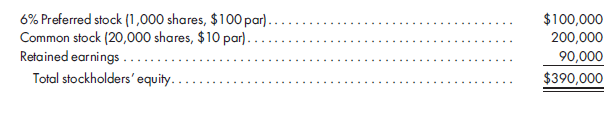

D D with preferred stock. On January 1, 2012, Boelter Company purchases 80% of the outstanding common stock of Mill Corporation for $280,000. On this date,Mill Corporation stockholders' equity is as follows:

Prepare a determination and distribution of excess schedule under each of the following situations (any excess of cost over book value is attributable to goodwill):

1. The preferred stock is cumulative, with dividends one year in arrears at January 1, 2012, and has a liquidation value equal to par.

2. The preferred stock is noncumulative but fully participating.

3. The preferred stock is cumulative, with dividends two years in arrears as of January 1, 2012, and has a liquidation value equal to 110% of par.

Prepare a determination and distribution of excess schedule under each of the following situations (any excess of cost over book value is attributable to goodwill):

1. The preferred stock is cumulative, with dividends one year in arrears at January 1, 2012, and has a liquidation value equal to par.

2. The preferred stock is noncumulative but fully participating.

3. The preferred stock is cumulative, with dividends two years in arrears as of January 1, 2012, and has a liquidation value equal to 110% of par.

Explanation

Calculation of preferred dividends in ar...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255