Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 10

Stock dividend, subsidiary stock sales, cost method. On January 1, 2011, Bear Corporation acquires a 60% interest in Kelly Company and an 80% interest in Samco Company. The purchase prices are $225,000 and $250,000, respectively. The excess of cost over book value for each investment is considered to be goodwill.

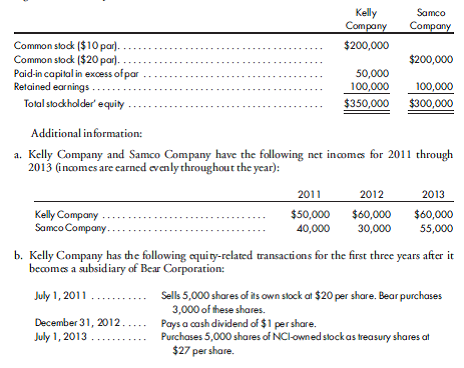

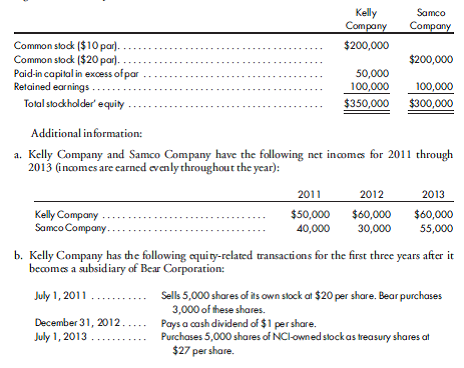

Immediately prior to the purchases, Kelly Company and Samco Company have the following stockholders' equities

c. Samco Company has the following equity-related transactions for the first three years after it becomes a subsidiary of Bear Corporation:

December 31, 2011.. Issues a 10% stock dividend. The estimated fair value of Samco common stock is $30 per share on the declaration date.

October 1, 2012..... Sells 4,000 shares of its own stock at $30 per share. Of these shares, 200 are purchased by Bear.

d. Bear Corporation has $200,000 of additional paid-in capital in excess of par on December 31, 2013.

Bear Corporation uses the cost method to account for its investments in subsidiaries. Convert its investments to the simple equity method as of December 31, 2013, and provide adequate support for the entries. Assume that the 2013 nominal accounts are closed. Prepare D D schedules for each investment.

Immediately prior to the purchases, Kelly Company and Samco Company have the following stockholders' equities

c. Samco Company has the following equity-related transactions for the first three years after it becomes a subsidiary of Bear Corporation:

December 31, 2011.. Issues a 10% stock dividend. The estimated fair value of Samco common stock is $30 per share on the declaration date.

October 1, 2012..... Sells 4,000 shares of its own stock at $30 per share. Of these shares, 200 are purchased by Bear.

d. Bear Corporation has $200,000 of additional paid-in capital in excess of par on December 31, 2013.

Bear Corporation uses the cost method to account for its investments in subsidiaries. Convert its investments to the simple equity method as of December 31, 2013, and provide adequate support for the entries. Assume that the 2013 nominal accounts are closed. Prepare D D schedules for each investment.

Explanation

Adjustment of identifiable accounts

B...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255