Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 16

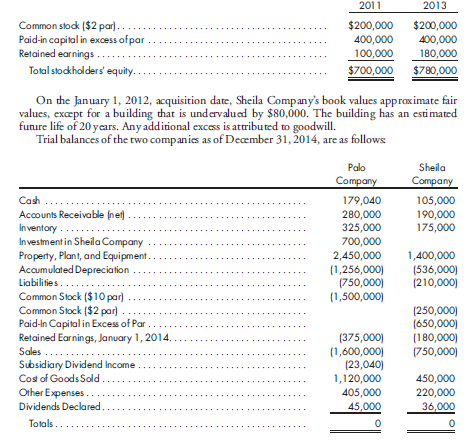

Worksheet, subsidiary stock sale, intercompany merchandise. On January 1, 2012, Palo Company acquires 80% of the outstanding common stock of Sheila Company for $700,000.

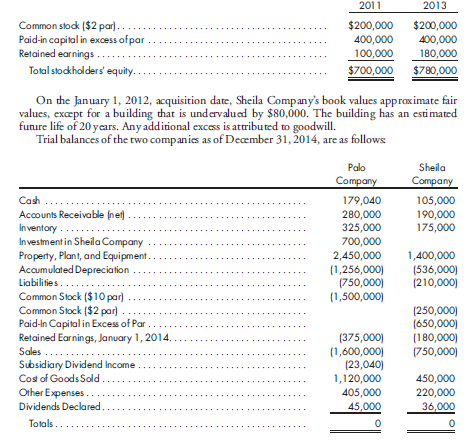

On January 1, 2014, Sheila Company sells 25,000 shares of common stock to the public at $12 per share. Palo Company does not purchase any of these shares. No entry has been made by the parent. Sheila Company has the following stockholders' equity at the end of 2011 and 2013:

During 2014, Sheila Company sells $50,000 of merchandise to Palo Company at a price that includes a 20% gross profit. This is their first intercompany sale. $10,000 of the goods remains in Palo's ending inventory.

Prepare the worksheet necessary to produce the consolidated financial statements of Palo Company and its subsidiary as of December 31, 2014. Include the determination and distribution of excess and income distribution schedules.

On January 1, 2014, Sheila Company sells 25,000 shares of common stock to the public at $12 per share. Palo Company does not purchase any of these shares. No entry has been made by the parent. Sheila Company has the following stockholders' equity at the end of 2011 and 2013:

During 2014, Sheila Company sells $50,000 of merchandise to Palo Company at a price that includes a 20% gross profit. This is their first intercompany sale. $10,000 of the goods remains in Palo's ending inventory.

Prepare the worksheet necessary to produce the consolidated financial statements of Palo Company and its subsidiary as of December 31, 2014. Include the determination and distribution of excess and income distribution schedules.

Explanation

Calculation of converting the investment...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255