Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 19

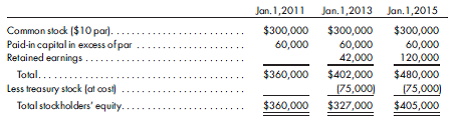

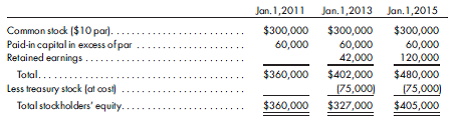

Subsidiary treasury stock. The following comparative statements of stockholders' equity are prepared for Nolan Corporation:

Tarman Corporation acquires 60% of Nolan Corporation common stock for $12 per share on January 1, 2011, when the latter corporation is formed.

On January 1, 2013, Nolan Corporation purchases 5,000 shares of its own common stock from noncontrolling interests for $15 per share. These shares are accounted for as treasury stock at cost.

Assuming Tarman Corporation uses the cost method to record its investment in Nolan Corporation, prepare the necessary cost-to-simple-equity conversion and the eliminations and adjustments required on the consolidated worksheet as of December 31, 2015. Include all pertinent supporting calculations in good form.

Tarman Corporation acquires 60% of Nolan Corporation common stock for $12 per share on January 1, 2011, when the latter corporation is formed.

On January 1, 2013, Nolan Corporation purchases 5,000 shares of its own common stock from noncontrolling interests for $15 per share. These shares are accounted for as treasury stock at cost.

Assuming Tarman Corporation uses the cost method to record its investment in Nolan Corporation, prepare the necessary cost-to-simple-equity conversion and the eliminations and adjustments required on the consolidated worksheet as of December 31, 2015. Include all pertinent supporting calculations in good form.

Explanation

Calculate controlling interest in 2015:

...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255