Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 22

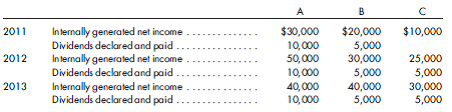

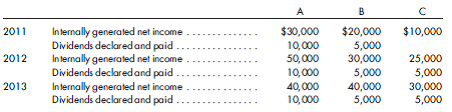

Three-level acquisition. You have secured the following information for Companies A, B, and C concerning their internally generated net incomes (excluding subsidiary income) and dividends paid:

1. Assume Company A acquires an 80% interest in Company B on January 1, 2011, and Company B acquires a 60% interest in Company C on January 1, 2012. Prepare the simple equity method adjusting entries made by Companies A and B for subsidiary investments for the years 2011 through 2013.

2. Assume Company B acquires a 70% interest in Company C on January 1, 2011, and Company A acquires a 90% interest in Company B on January 1, 2013. Prepare the simple equity method adjusting entries made by Companies A and B for subsidiary investments for the years 2011 through 2013.

1. Assume Company A acquires an 80% interest in Company B on January 1, 2011, and Company B acquires a 60% interest in Company C on January 1, 2012. Prepare the simple equity method adjusting entries made by Companies A and B for subsidiary investments for the years 2011 through 2013.

2. Assume Company B acquires a 70% interest in Company C on January 1, 2011, and Company A acquires a 90% interest in Company B on January 1, 2013. Prepare the simple equity method adjusting entries made by Companies A and B for subsidiary investments for the years 2011 through 2013.

Explanation

It is given that B company net income is...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255