Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 3

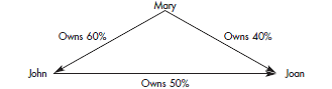

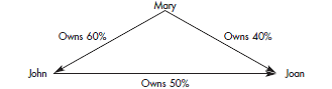

Worksheet, direct and indirect holding, intercompany merchandise, machine. The following diagram depicts the relationships among Mary Company, John Company, and Joan Company on December 31, 2014:

Mary Company purchases its interest in John Company on January 1, 2012, for $204,000. John Company purchases its interest in Joan Company on January 1, 2013, for $75,000. Mary Company purchases its interest in Joan Company on January 1, 2014, for $72,000. All investments are accounted for under the equity method. Control over Joan Company does not occur until the January 1, 2014, acquisition. Thus, a D D schedule will be prepared for the investment in Joan as of January 1, 2014.

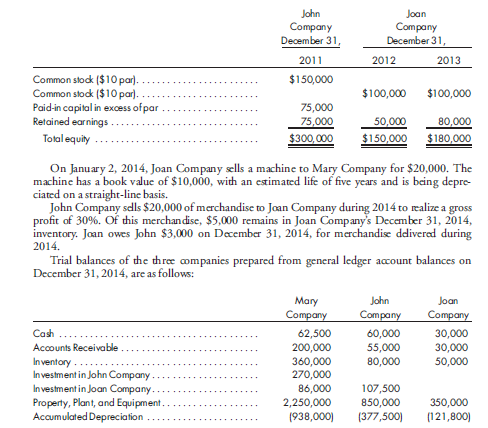

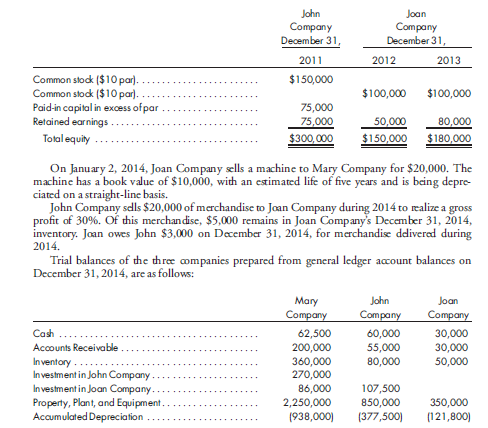

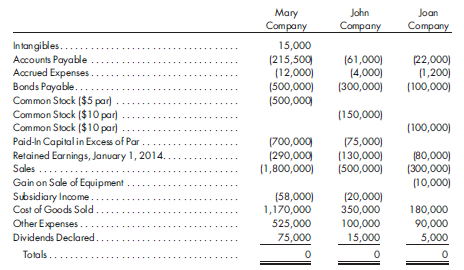

The following stockholders' equities are available:

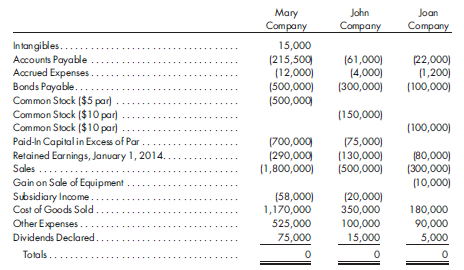

Prepare the worksheet necessary to produce the consolidated financial statements of Mary Company and its subsidiaries as of December 31, 2014. Include the determination and distribution of excess and income distribution schedules. Any excess of cost is assumed to be attributable to goodwill.

Mary Company purchases its interest in John Company on January 1, 2012, for $204,000. John Company purchases its interest in Joan Company on January 1, 2013, for $75,000. Mary Company purchases its interest in Joan Company on January 1, 2014, for $72,000. All investments are accounted for under the equity method. Control over Joan Company does not occur until the January 1, 2014, acquisition. Thus, a D D schedule will be prepared for the investment in Joan as of January 1, 2014.

The following stockholders' equities are available:

Prepare the worksheet necessary to produce the consolidated financial statements of Mary Company and its subsidiaries as of December 31, 2014. Include the determination and distribution of excess and income distribution schedules. Any excess of cost is assumed to be attributable to goodwill.

Explanation

Calculate non-controlling interest value...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255