Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 5

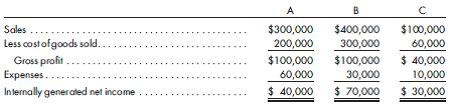

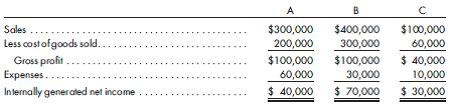

Three-level acquisition, inventory and fixed asset sales. Companies A, B, and C produce the following separate internally generated net incomes during 2015:

Company A acquires an 80% interest in Company B on January 1, 2012, and Company B acquires a 60% interest in Company C on January 1, 2013. Each investment is acquired at a price equal to the book value of the stock purchased.

Additional information is as follows:

a. Company A purchases goods billed at $30,000 from Company C during 2015. The price includes a 40% gross profit. One-half of the goods are held in Company A's year-end inventory.

b. Company B purchases goods billed at $30,000 from Company A during 2015. Company A always bills Company B at a price that includes a 30% gross profit. Company B has $6,000 of Company A goods in its beginning inventory and $2,400 of Company A goods in its ending inventory.

c. Company C purchases goods billed at $15,000 from Company B during 2015. Company B bills Company C at a 20% gross profit. At year-end, $7,500 of the goods remains unsold. The goods are inventoried at $5,000, under the lower-of-cost-or-market procedure.

d. Company B sells a machine to Company C on January 1, 2014, for $50,000. Company B's cost is $70,000, and accumulated depreciation on the date of sale is $40,000. The machine is being depreciated on a straight-line basis over five years.

Prepare the consolidated income statement for 2015, including the distribution of consolidated net income supported by distribution schedules.

Company A acquires an 80% interest in Company B on January 1, 2012, and Company B acquires a 60% interest in Company C on January 1, 2013. Each investment is acquired at a price equal to the book value of the stock purchased.

Additional information is as follows:

a. Company A purchases goods billed at $30,000 from Company C during 2015. The price includes a 40% gross profit. One-half of the goods are held in Company A's year-end inventory.

b. Company B purchases goods billed at $30,000 from Company A during 2015. Company A always bills Company B at a price that includes a 30% gross profit. Company B has $6,000 of Company A goods in its beginning inventory and $2,400 of Company A goods in its ending inventory.

c. Company C purchases goods billed at $15,000 from Company B during 2015. Company B bills Company C at a 20% gross profit. At year-end, $7,500 of the goods remains unsold. The goods are inventoried at $5,000, under the lower-of-cost-or-market procedure.

d. Company B sells a machine to Company C on January 1, 2014, for $50,000. Company B's cost is $70,000, and accumulated depreciation on the date of sale is $40,000. The machine is being depreciated on a straight-line basis over five years.

Prepare the consolidated income statement for 2015, including the distribution of consolidated net income supported by distribution schedules.

Explanation

Calculation of subsidiary Inco...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255