Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 15

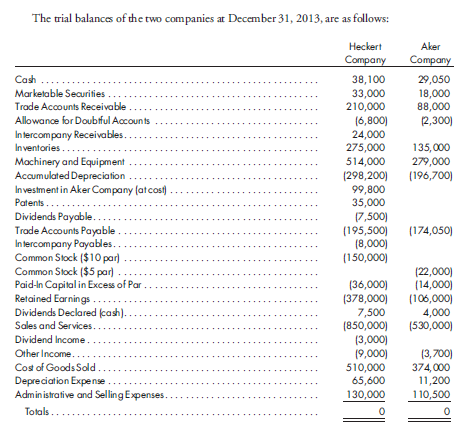

Worksheet, purchase in blocks, subsidiary stock dividend, subsidiary purchase of parent shares, machinery sale, merchandise. On January 1, 2013, Heckert Company purchases a controlling interest in Aker Company. The following information is available:

a. Heckert Company purchases 1,600 shares of Aker Company outstanding stock on January 1, 2012, for $48,000 and purchases an additional 1,400 shares on January 1, 2013, for $51,800.

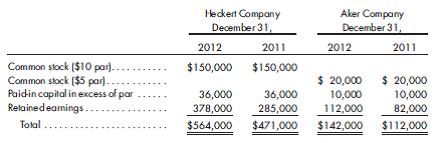

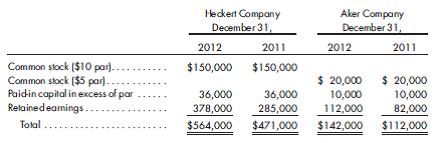

b. An analysis of the stockholders' equity accounts at December 31, 2012, and 2011, follows:

c. Aker Company's marketable securities consist of 1,500 shares of Heckert Company stock purchased on June 15, 2013, in the open market for $18,000. The securities are purchased as a temporary investment and are sold on January 15, 2014, for $25,000.

d. On December 10, 2013, Heckert Company declares a cash dividend of $0.50 per share, payable January 10, 2014, to stockholders of record on December 20, 2013. Aker Company pays a cash dividend of $1 per share on June 30, 2013, and distributes a 10% stock dividend on September 30, 2013. The stock is selling for $15 per share ex-dividend on September 30, 2013. Aker Company pays no dividends in 2012.

e. Aker Company sells machinery, with a book value of $4,000 and a remaining life of five years, to Heckert Company for $4,800 on December 31, 2013. The gain on the sale is credited to the other income account.

f. Aker Company includes all intercompany receivables and payables in its trade accounts receivable and trade accounts payable accounts.

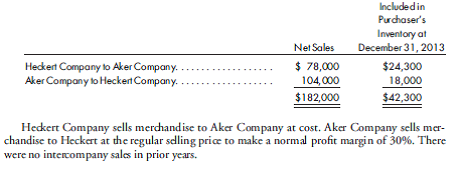

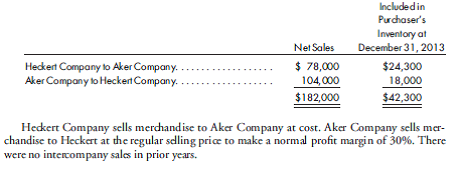

g. During 2013, the following intercompany sales are made:

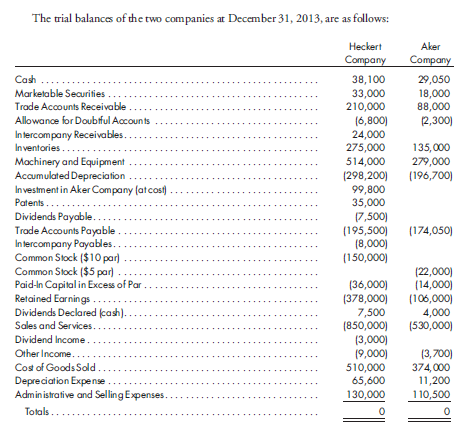

Prepare the worksheet necessary to produce the consolidated financial statements of Heckert Company and its subsidiary for the year ended December 31, 2013. Include the determination and distribution of excess and income distribution schedules. Assume any excess of cost over book value is attributable to goodwill.

a. Heckert Company purchases 1,600 shares of Aker Company outstanding stock on January 1, 2012, for $48,000 and purchases an additional 1,400 shares on January 1, 2013, for $51,800.

b. An analysis of the stockholders' equity accounts at December 31, 2012, and 2011, follows:

c. Aker Company's marketable securities consist of 1,500 shares of Heckert Company stock purchased on June 15, 2013, in the open market for $18,000. The securities are purchased as a temporary investment and are sold on January 15, 2014, for $25,000.

d. On December 10, 2013, Heckert Company declares a cash dividend of $0.50 per share, payable January 10, 2014, to stockholders of record on December 20, 2013. Aker Company pays a cash dividend of $1 per share on June 30, 2013, and distributes a 10% stock dividend on September 30, 2013. The stock is selling for $15 per share ex-dividend on September 30, 2013. Aker Company pays no dividends in 2012.

e. Aker Company sells machinery, with a book value of $4,000 and a remaining life of five years, to Heckert Company for $4,800 on December 31, 2013. The gain on the sale is credited to the other income account.

f. Aker Company includes all intercompany receivables and payables in its trade accounts receivable and trade accounts payable accounts.

g. During 2013, the following intercompany sales are made:

Prepare the worksheet necessary to produce the consolidated financial statements of Heckert Company and its subsidiary for the year ended December 31, 2013. Include the determination and distribution of excess and income distribution schedules. Assume any excess of cost over book value is attributable to goodwill.

Explanation

Calculation of H Company and subsidiary ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255