Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 17

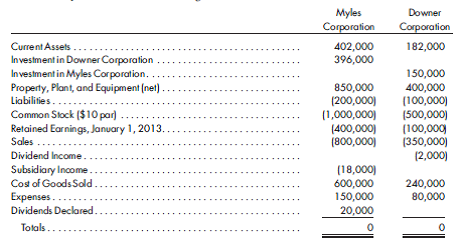

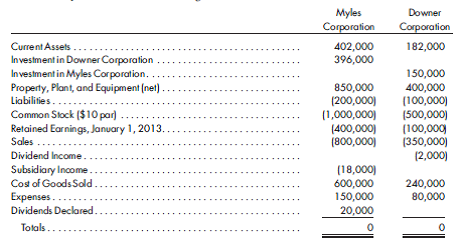

Treasury stock method. Myles Corporation and its subsidiary, Downer Corporation, have the following trial balances as of December 31, 2013:

Myles Corporation acquires its 60% interest in Downer Corporation for $348,000 on January 1, 2011. At that time, Downer's retained earnings balance is $50,000. Any excess of cost over book value is attributed to equipment and given a 20-year life.

Downer Corporation purchases a 10% interest in Myles Corporation on January 1, 2013, for $150,000.

No intercompany transactions occur during 2013.

1. Prepare determination and distribution of excess schedules for the investment in Downer.

2. Prepare the 2013 consolidated income statement, including the consolidated net income distribution, using the treasury stock method for mutual holdings. Prepare the supporting income distribution schedules.

Myles Corporation acquires its 60% interest in Downer Corporation for $348,000 on January 1, 2011. At that time, Downer's retained earnings balance is $50,000. Any excess of cost over book value is attributed to equipment and given a 20-year life.

Downer Corporation purchases a 10% interest in Myles Corporation on January 1, 2013, for $150,000.

No intercompany transactions occur during 2013.

1. Prepare determination and distribution of excess schedules for the investment in Downer.

2. Prepare the 2013 consolidated income statement, including the consolidated net income distribution, using the treasury stock method for mutual holdings. Prepare the supporting income distribution schedules.

Explanation

Determination and Distribution of Excess...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255