Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 1

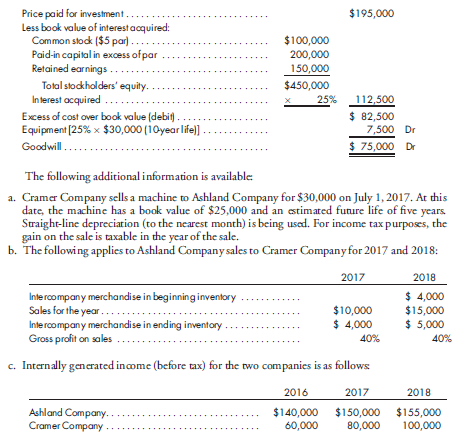

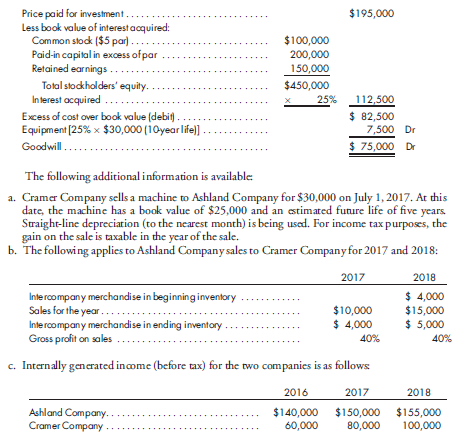

Equity income, taxation, inventory, fixed asset sale. On January 1, 2016, Ashland Company purchases a 25% interest in Cramer Company for $195,000. Ashland Company prepares the following determination and distribution of excess schedule:

d. Cramer pays dividends of $5,000, $10,000, and $10,000 in 2016, 2017, and 2018, respectively.

e. The corporate income tax rate of 30% applies to both companies. Assume an 80% dividend exclusion.

Prepare all equity method adjustments for Ashland Company's investment in Cramer Company on December 31, 2016, 2017, and 2018. Consider income tax implications. Supporting calculations and schedules should be in good form.

d. Cramer pays dividends of $5,000, $10,000, and $10,000 in 2016, 2017, and 2018, respectively.

e. The corporate income tax rate of 30% applies to both companies. Assume an 80% dividend exclusion.

Prepare all equity method adjustments for Ashland Company's investment in Cramer Company on December 31, 2016, 2017, and 2018. Consider income tax implications. Supporting calculations and schedules should be in good form.

Explanation

• Provision for income tax account is de...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255