Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 3

Equity method, change in interest. Hanson Corporation purchases a 10% interest in Novic Company on January 1, 2016, and an additional 15% interest on January 1, 2018. These investments cost Hanson Corporation $80,000 and $110,000, respectively.

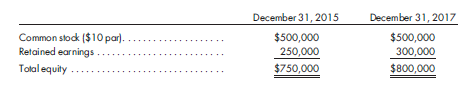

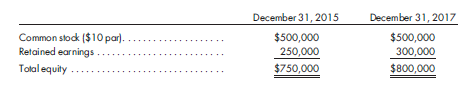

The following stockholders' equities of Novic Company are available:

Any excess of cost over book value on the original investment is attributed to goodwill. Any excess on the second purchase is attributable to equipment with a 4-year life.

Novic Company has income of $30,000, $30,000, and $40,000 for 2016, 2017, and 2018, respectively. Novic pays dividends of $0.20 per share in 2017 and 2018.

Ignore income tax considerations, and assume equity method adjusting entries are made at the end of the calendar year only.

1. Prepare the cost-to-equity conversion entry on January 1, 2018, when Hanson's investment in Novic Company first exceeds 20%. Any supporting schedules should be in good form.

2. Prepare the December 31, 2018, equity adjustment on Hanson's books. Provide supporting calculations in good form.

The following stockholders' equities of Novic Company are available:

Any excess of cost over book value on the original investment is attributed to goodwill. Any excess on the second purchase is attributable to equipment with a 4-year life.

Novic Company has income of $30,000, $30,000, and $40,000 for 2016, 2017, and 2018, respectively. Novic pays dividends of $0.20 per share in 2017 and 2018.

Ignore income tax considerations, and assume equity method adjusting entries are made at the end of the calendar year only.

1. Prepare the cost-to-equity conversion entry on January 1, 2018, when Hanson's investment in Novic Company first exceeds 20%. Any supporting schedules should be in good form.

2. Prepare the December 31, 2018, equity adjustment on Hanson's books. Provide supporting calculations in good form.

Explanation

1)Determination and Distribution of Exce...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255