Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 4

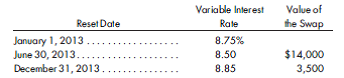

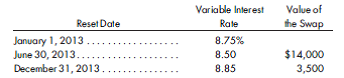

Fair value hedge-an interest rate swap's effect on interest and the carrying value of a note. On July 1, 2012, Hargrove Corporation issued a 2-year note with a face value of $4,000,000 and a fixed interest rate of 9%, payable on a semiannual basis. On January 15, 2013, the company entered into an interest rate swap with a financial institution in anticipation of lower variable rates. At the initial date of the swap, the company paid a premium of $9,200. The swap had a notional amount of $4,000,000 and called for the payment of a variable rate of interest in exchange for a 9% fixed rate. The variable rates are reset semiannually beginning with January 1, 2013, in order to determine the next interest payment. Differences between rates on the swap will be settled on a semiannual basis. Variable interest rates and the value of the swap on selected dates are as follows:

For each of the above dates, determine:

1. The net interest expense.

2. The carrying value of the note payable.

3. The net unrealized gain or loss on the swap.

For each of the above dates, determine:

1. The net interest expense.

2. The carrying value of the note payable.

3. The net unrealized gain or loss on the swap.

Explanation

1)It is given that the face value is $40...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255