Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 11

Income statement effects of transactions, commitments, and hedging. Clayton Industries sells medical equipment worldwide. On March 1 of the current year, the company sold equipment, with a cost of $160,000, to a foreign customer for 200,000 euros payable in 60 days. At the same time, the company purchased a forward contract to sell 200,000 euros in 60 days. In another transaction, the company committed, on March 15, to deliver equipment in May to a foreign customer in exchange for 300,000 euros payable in June. This equipment is anticipated to have a completed cost of $210,000. On March 15, the company hedged the commitment by acquiring a forward contract to sell 300,000 euros in 90 days. Changes in the value of the commitment are based on changes in forward rates, and all discounting is based on a 6% discount rate.

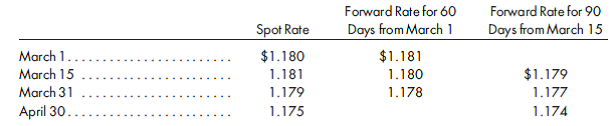

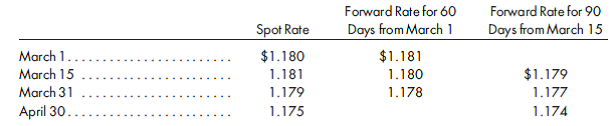

Various spot and forward rates for the euro are as follows:

For individual months ofMarch and April, calculate the income statement effect of:

1. The foreign currency transaction.

2. The hedge on the foreign currency transaction.

3. The foreign currency commitment.

4. The hedge on the foreign currency commitment.

Various spot and forward rates for the euro are as follows:

For individual months ofMarch and April, calculate the income statement effect of:

1. The foreign currency transaction.

2. The hedge on the foreign currency transaction.

3. The foreign currency commitment.

4. The hedge on the foreign currency commitment.

Explanation

1)Foreign currency transaction...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255