Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 21

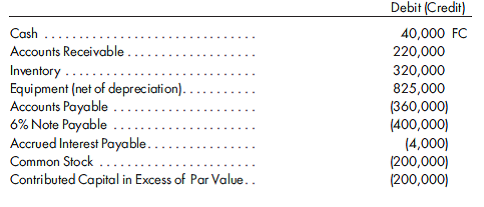

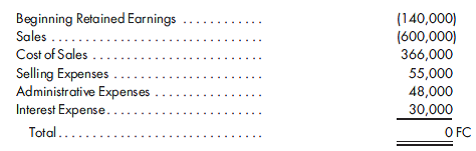

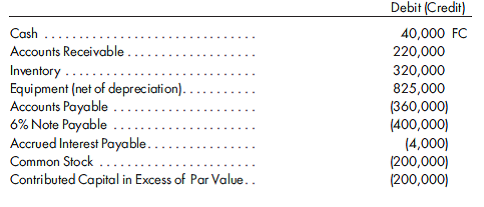

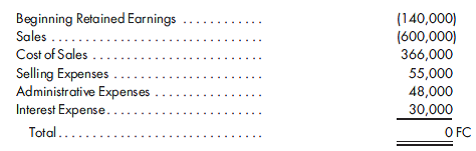

Hedging a net investment in a foreign subsidiary. Crosswell, Inc., has a 100% interest in a foreign subsidiary whose functional currency is the FC. The interest is acquired when 1 FC = $1.45. As of September 30, 2014, the preclosing trial balance as of December 31, 2014, is forecasted to be as follows:

Actual exchange rates between the FC and the dollar are 1 FC ¼ $1.40 as of January 1, 2014, and $1.24 as of September 30, 2014. It is estimated that the year-end 2014 rate will be 1 FC ¼ $1.20 and that the 2014 weighted-average rate will be 1 FC ¼ $1.28.

Crosswell is considering hedging its investment in the foreign subsidiary by borrowing or lending FC as of September 30, 2014. The annual interest rate will be 6% with interest-only payments due at the end of each calendar quarter. At year-end 2013, the cumulative translation adjustment was a $120,000 debit balance. Determine the amount of the FC hedge that would be necessary to offset the 2014 change in the translation adjustment. Assume that the translated value of retained earnings at December 31, 2013, was $200,000.

Actual exchange rates between the FC and the dollar are 1 FC ¼ $1.40 as of January 1, 2014, and $1.24 as of September 30, 2014. It is estimated that the year-end 2014 rate will be 1 FC ¼ $1.20 and that the 2014 weighted-average rate will be 1 FC ¼ $1.28.

Crosswell is considering hedging its investment in the foreign subsidiary by borrowing or lending FC as of September 30, 2014. The annual interest rate will be 6% with interest-only payments due at the end of each calendar quarter. At year-end 2013, the cumulative translation adjustment was a $120,000 debit balance. Determine the amount of the FC hedge that would be necessary to offset the 2014 change in the translation adjustment. Assume that the translated value of retained earnings at December 31, 2013, was $200,000.

Explanation

Proof: In case the borrowing...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255