Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 1

Analyzing the effect of alternative functional currencies. Patterson Distributors, Inc., purchases various electronic components from a variety of manufacturers and then distributes the products to end users. In the past, both domestic and foreign manufacturers of the components shipped the product to Patterson's two U.S. distribution warehouses. In order to reduce costs and serve its customers on a timelier basis, Patterson is considering opening two international distribution centers. The company will form a 100%-owned foreign subsidiary to own the centers. The foreign subsidiary will need to secure financing and build and furnish a distribution warehouse in each location.

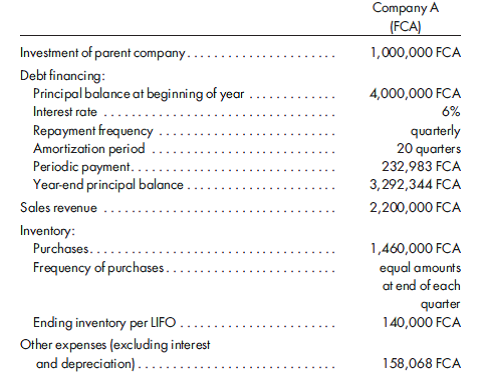

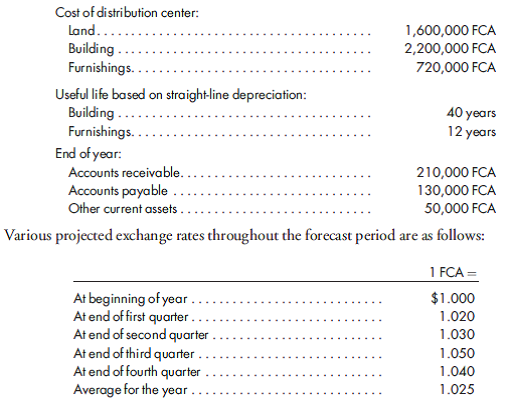

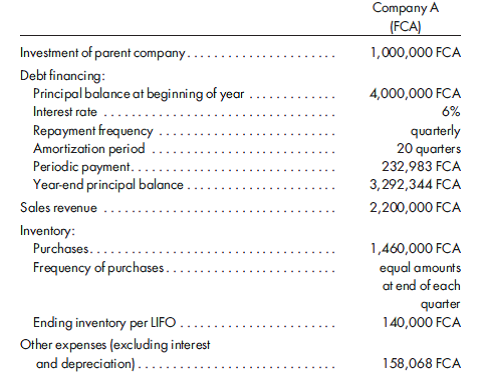

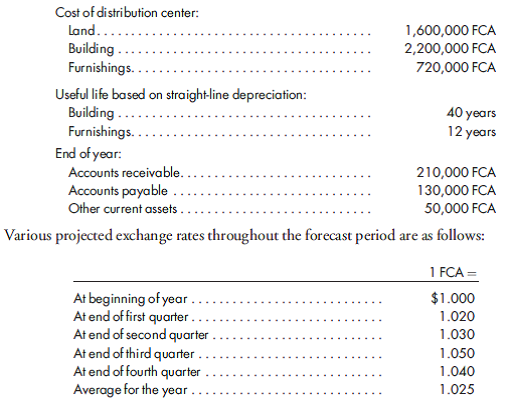

Projections, in the respective country's foreign currency (FCA), for the first 12 months of operations are as follows

Although Patterson has prepared the projections in the respective foreign currencies, the company has the ability to structure transactions in such a way that either the foreign currency or the U.S. dollar is the functional currency.

1. Construct a year-end trial balance for the foreign subsidiary. Based on the information provided, calculate the translation adjustment and remeasurement gain or loss for the subsidiary assuming that the functional currency is the FCA and the dollar, respectively.

2. Discuss, in retrospect, whether the parent company would want to hedge its investment and, if so, how that might be accomplished.

3. Assume that the parent did hedge its investment in the subsidiary. This was accomplished by borrowing 600,000 FCA at the end of the first quarter. No principal payments were made during the year. How much of the gain or loss on this hedge would have been considered ineffective against the translation adjustment? The remeasurement gain?

Projections, in the respective country's foreign currency (FCA), for the first 12 months of operations are as follows

Although Patterson has prepared the projections in the respective foreign currencies, the company has the ability to structure transactions in such a way that either the foreign currency or the U.S. dollar is the functional currency.

1. Construct a year-end trial balance for the foreign subsidiary. Based on the information provided, calculate the translation adjustment and remeasurement gain or loss for the subsidiary assuming that the functional currency is the FCA and the dollar, respectively.

2. Discuss, in retrospect, whether the parent company would want to hedge its investment and, if so, how that might be accomplished.

3. Assume that the parent did hedge its investment in the subsidiary. This was accomplished by borrowing 600,000 FCA at the end of the first quarter. No principal payments were made during the year. How much of the gain or loss on this hedge would have been considered ineffective against the translation adjustment? The remeasurement gain?

Explanation

Note B:

Calculation of interest expense...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255