Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 11

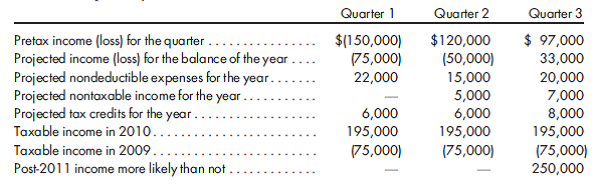

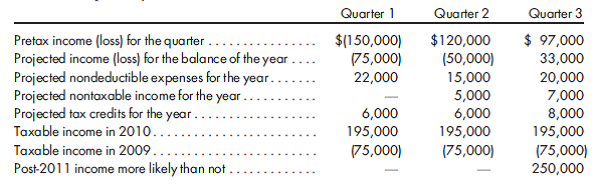

Estimating the effective tax rate. Roberts Corporation began operations in 2009 and finally began to report pretax profits in 2010. However, a major economic downturn in 2011 has negatively impacted the company's operations.

For each of the following quarters of 2011, determine the tax expense or benefit traceable to that quarter. Assume that the statutory tax rates for years 2009 through 2011 are 25%, 30%, and 35%, respectively.

Assume that all current-year (2011) taxable losses and tax credits may be carried back against the prior two years to whatever extent possible. No tax credits were available in years 2009 and 2010.

For each of the following quarters of 2011, determine the tax expense or benefit traceable to that quarter. Assume that the statutory tax rates for years 2009 through 2011 are 25%, 30%, and 35%, respectively.

Assume that all current-year (2011) taxable losses and tax credits may be carried back against the prior two years to whatever extent possible. No tax credits were available in years 2009 and 2010.

Explanation

Assumption: Statutory tax rates for year...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255