Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 14

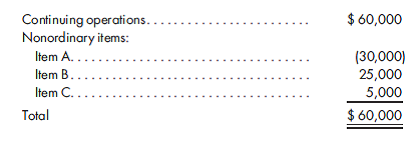

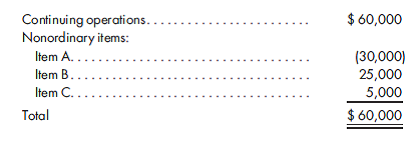

Ratable allocation for nonordinary items. Baxter Corporation anticipated pretax values for the current year as follows:

The statutory tax rates are as follows: 15% on the first $50,000, 25% on the next $25,000, 34% on the next $25,000, and 39% on amounts in excess of $100,000.

Determine the tax expense traceable to nonordinary items B and C.

The statutory tax rates are as follows: 15% on the first $50,000, 25% on the next $25,000, 34% on the next $25,000, and 39% on amounts in excess of $100,000.

Determine the tax expense traceable to nonordinary items B and C.

Explanation

Calculation of tax expenses to non-ordin...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255