Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 6

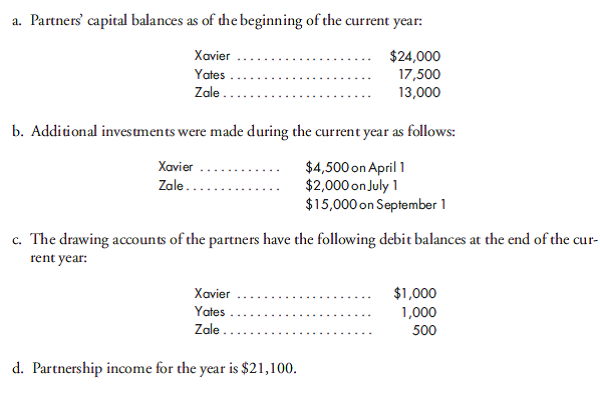

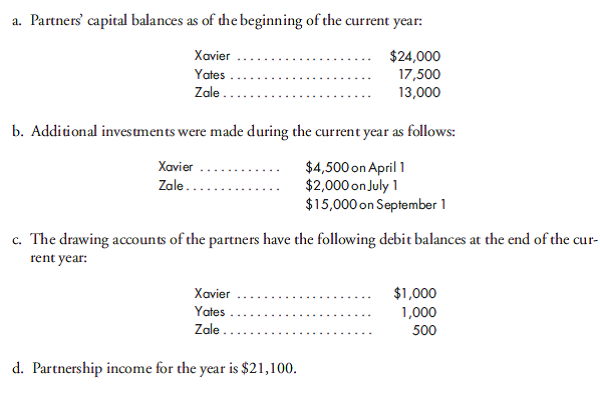

Interest calculation; determination of capital account balances. Xavier, Yates, and Zale are partners in a dry-cleaning business. Their partnership agreement provides that the partners shall receive interest on their respective average yearly capital balances at the rate of 8%. Any residual profits or losses shall be divided equally among the partners. The following information is available for the current calendar year:

1. Discuss the advantages and disadvantages of using the weighted-average capital balance as the base for determining interest on capital contributed.

2. Determine the interest on weighted-average capital balances that partners Xavier, Yates, and Zale should receive for the current year. Assume that the partners' withdrawals are not to influence the capital balances for purposes of computing interest.

3. Determine the capital account balances for Xavier, Yates, and Zale after all closing entries have been journalized and posted at the end of the current year. Supporting schedules should be in good form.

1. Discuss the advantages and disadvantages of using the weighted-average capital balance as the base for determining interest on capital contributed.

2. Determine the interest on weighted-average capital balances that partners Xavier, Yates, and Zale should receive for the current year. Assume that the partners' withdrawals are not to influence the capital balances for purposes of computing interest.

3. Determine the capital account balances for Xavier, Yates, and Zale after all closing entries have been journalized and posted at the end of the current year. Supporting schedules should be in good form.

Explanation

1. The Advantages and Disadvantages of W...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255