Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 13

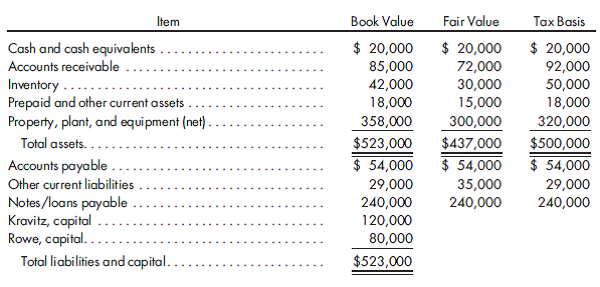

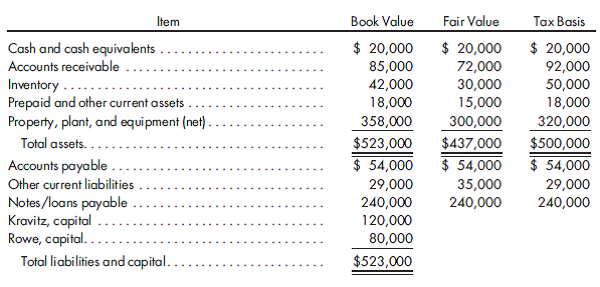

New partner, asset and capital balance determination, bonus, goodwill. Kravitz and Rowe are partners in an excavating business known as K R Excavating. The partners are considering a number of options regarding the partnership, including the admission of a new partner and a potential sale of the partnership. The following information has been prepared as a basis for evaluating various alternatives:

The partners currently share profits and losses 60% and 40%, respectively, for Kravitz and Rowe.

Given the preceding information, respond to each of the following items:

1. Given the stated fair values, if Rowe were to sell one-half of her interest in capital to someone outside the partnership, what would be a suggested asking price?

2. Given the stated fair values, if a third party were to convey assets to the partnership in exchange for a 40% interest in the partnership, what would the value of those assets have to be?

3. Assume a new partner was admitted to the partnership with a 40% interest in capital in exchange for a cash contribution of $60,000. What would Rowe's capital balance be as a result of this transaction, assuming use of the bonus method?

4. Given the facts of (3) above, what would Rowe's capital balance be, assuming use of the goodwill method?

5. Assume a new partner was admitted to the partnership with a 30% interest in capital in exchange for a contribution of $55,000 of net tangible assets. What would the new partner's capital balance be as a result of this transaction, assuming use of the bonus method?

The partners currently share profits and losses 60% and 40%, respectively, for Kravitz and Rowe.

Given the preceding information, respond to each of the following items:

1. Given the stated fair values, if Rowe were to sell one-half of her interest in capital to someone outside the partnership, what would be a suggested asking price?

2. Given the stated fair values, if a third party were to convey assets to the partnership in exchange for a 40% interest in the partnership, what would the value of those assets have to be?

3. Assume a new partner was admitted to the partnership with a 40% interest in capital in exchange for a cash contribution of $60,000. What would Rowe's capital balance be as a result of this transaction, assuming use of the bonus method?

4. Given the facts of (3) above, what would Rowe's capital balance be, assuming use of the goodwill method?

5. Assume a new partner was admitted to the partnership with a 30% interest in capital in exchange for a contribution of $55,000 of net tangible assets. What would the new partner's capital balance be as a result of this transaction, assuming use of the bonus method?

Explanation

1. Find the suggested asking price, if M...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255