Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 19

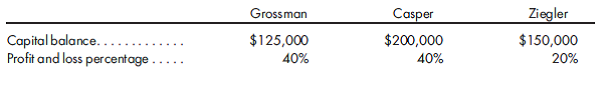

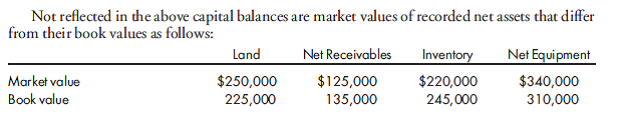

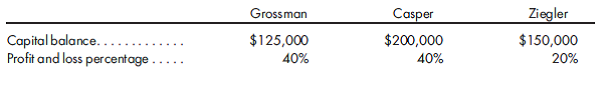

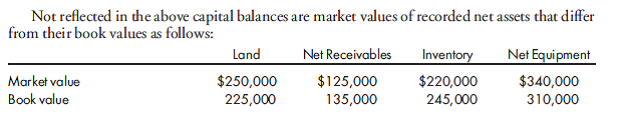

Impact on capital balances of a partner withdrawing. After being a partner for over 10 years, Ziegler has decided to sell her interest in a partnership with Grossman and Casper. Prior to the date of the sale and subsequent to the allocation of profits and drawing balances, information concerning the partners was as follows:

Determine the capital balances for Grossman and Casper assuming that Ziegler sells her interest in the partnership under the following independent scenarios.

1. Ziegler sells her interest to Grossman for $160,000, and the price paid is not used to recognize changes in value of recorded net assets of the entity.

2. Ziegler sells her interest to Grossman for $160,000, and the price paid is used to only recognize decreases in value of existing assets.

3. Ziegler sells her interest to the partnership for $160,000, and the bonus method is used to account for the transaction. Suggested decreases in the value of assets are recognized.

4. Ziegler sells her interest to the partnership for $160,000, and the goodwill traceable to the withdrawing partner is recognized. Suggested decreases in the value of assets are recognized.

5. Ziegler sells her interest to the partnership for $160,000, and the goodwill traceable to the entire partnership entity is recognized. Suggested decreases in the value of assets are recognized.

6. Ziegler sells her interest to the partnership for $160,000, and the goodwill traceable to the entire partnership entity is recognized. All changes in the value of existing assets are recognized.

Determine the capital balances for Grossman and Casper assuming that Ziegler sells her interest in the partnership under the following independent scenarios.

1. Ziegler sells her interest to Grossman for $160,000, and the price paid is not used to recognize changes in value of recorded net assets of the entity.

2. Ziegler sells her interest to Grossman for $160,000, and the price paid is used to only recognize decreases in value of existing assets.

3. Ziegler sells her interest to the partnership for $160,000, and the bonus method is used to account for the transaction. Suggested decreases in the value of assets are recognized.

4. Ziegler sells her interest to the partnership for $160,000, and the goodwill traceable to the withdrawing partner is recognized. Suggested decreases in the value of assets are recognized.

5. Ziegler sells her interest to the partnership for $160,000, and the goodwill traceable to the entire partnership entity is recognized. Suggested decreases in the value of assets are recognized.

6. Ziegler sells her interest to the partnership for $160,000, and the goodwill traceable to the entire partnership entity is recognized. All changes in the value of existing assets are recognized.

Explanation

2.

Instance:

• Z sells her interest to...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255