Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 1

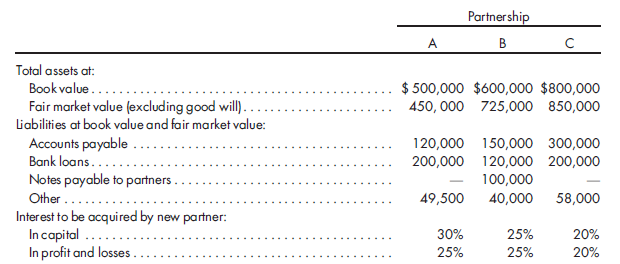

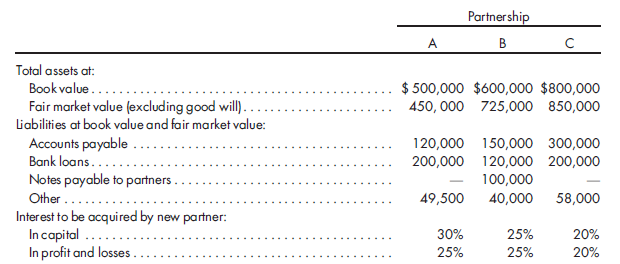

Determining the purchase price of a partnership interest. Meyers is considering investing in one of several existing partnerships and is attempting to consider the price to be paid for a partnership interest. In addition to investing cash, Meyers would be contributing a piece of land that has a fair market value of $50,000. The existing partnerships are characterized as follows:

1. Determine the amount of consideration that Meyers should have to convey in order to acquire an interest in each of the partnerships.

2. Assume that in addition to the land Meyers was asked to convey cash of $4,000, $60,000, and $15,000 to partnerships A through C, respectively. Determine the amount of goodwill to be recorded assuming that all assets are adjusted to fair value. Indicate to whom the goodwill is traceable.

1. Determine the amount of consideration that Meyers should have to convey in order to acquire an interest in each of the partnerships.

2. Assume that in addition to the land Meyers was asked to convey cash of $4,000, $60,000, and $15,000 to partnerships A through C, respectively. Determine the amount of goodwill to be recorded assuming that all assets are adjusted to fair value. Indicate to whom the goodwill is traceable.

Explanation

1. Determine the amount of consideration...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255