Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 3

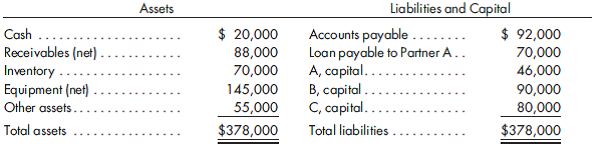

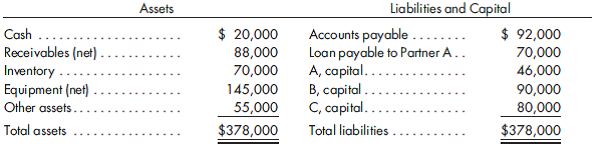

Amounts to be received by a partner during liquidation. A condensed balance sheet for a partnership to be liquidated is as follows:

The profit and loss percentages for Partners A, B, and C are 50%, 30%, and 20%, respectively. For each of the following independent scenarios, determine how much of the available cash, with the exception of $10,000, would be distributed to Partner B.

1. Assume that the receivables and the inventory were liquidated for $140,000 cash.

2. Assume that all noncash assets other than equipment were sold for $53,000 cash.

3. Assume that noncash assets with a book value of $300,000 were sold for $250,000 cash and that a distribution to Partner A was made in order to pay off the loan payable to them.

The profit and loss percentages for Partners A, B, and C are 50%, 30%, and 20%, respectively. For each of the following independent scenarios, determine how much of the available cash, with the exception of $10,000, would be distributed to Partner B.

1. Assume that the receivables and the inventory were liquidated for $140,000 cash.

2. Assume that all noncash assets other than equipment were sold for $53,000 cash.

3. Assume that noncash assets with a book value of $300,000 were sold for $250,000 cash and that a distribution to Partner A was made in order to pay off the loan payable to them.

Explanation

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255