Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 12

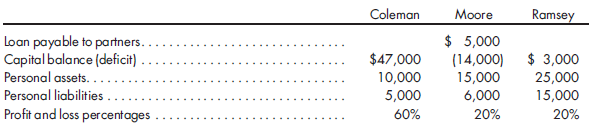

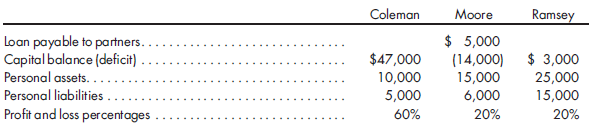

Installment liquidation with insolvent partners, deficit capital balances. Coleman, Moore, and Ramsey are partners in a business being liquidated. The partnership has cash of $8,000, noncash assets with a book value of $96,000, and liabilities of $63,000. The following information relates to the individual partners as of June 1, 2017:

On June 15, 2017, assets with a book value of $30,000 were sold for $20,000 cash. The proceeds were used to pay off liabilities of the partnership. During the balance of June, no additional assets were liquidated, and outside creditors began to pressure the partnership for payment. On July 1, the partners agreed to contribute personal assets, to the extent of their net personal assets, in order to eliminate their respective capital deficits. Shortly thereafter, assets with a book value of $20,000 and a fair value of $23,000 were distributed to Coleman. Assuming additional noncash assets with a book value of $40,000 are sold in July for $54,000, determine how available cash would be distributed.

On June 15, 2017, assets with a book value of $30,000 were sold for $20,000 cash. The proceeds were used to pay off liabilities of the partnership. During the balance of June, no additional assets were liquidated, and outside creditors began to pressure the partnership for payment. On July 1, the partners agreed to contribute personal assets, to the extent of their net personal assets, in order to eliminate their respective capital deficits. Shortly thereafter, assets with a book value of $20,000 and a fair value of $23,000 were distributed to Coleman. Assuming additional noncash assets with a book value of $40,000 are sold in July for $54,000, determine how available cash would be distributed.

Explanation

• Loss on the sale of Assets of $10,000 ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255