Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 17

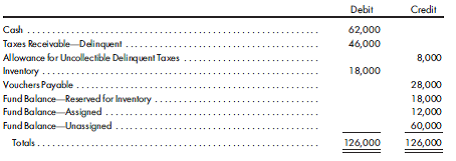

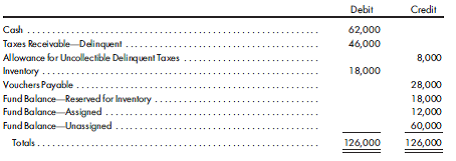

Journal entries, general fund. The general fund trial balance of the city of Oakpark at December 31, 2018, was as follows:

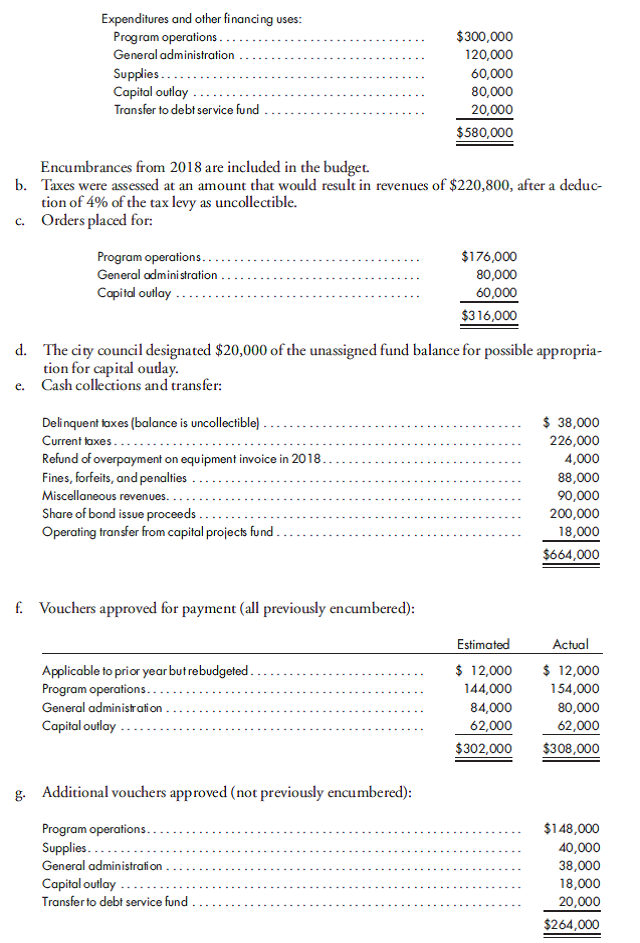

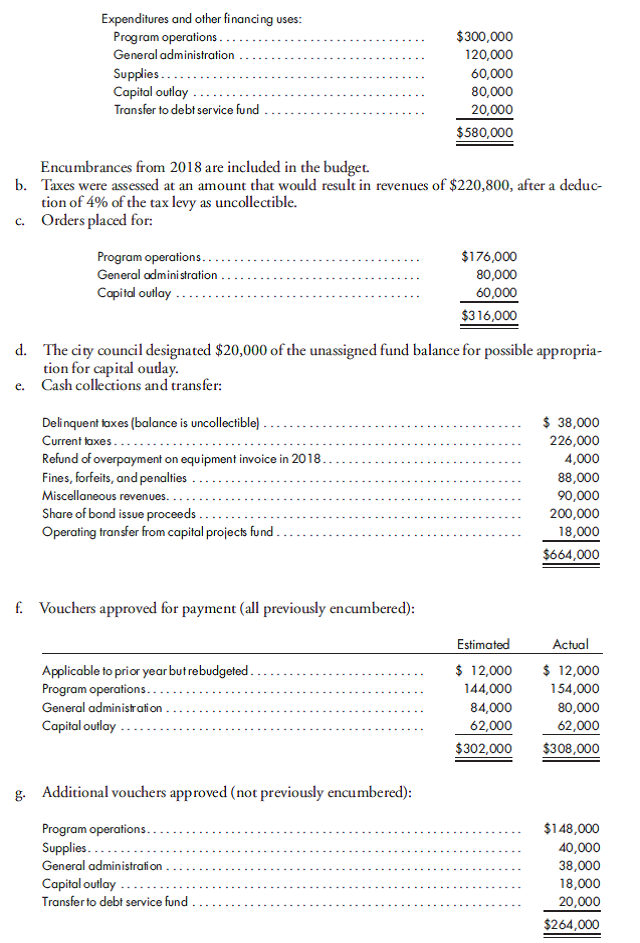

The following data pertain to 2019 general fund operations:

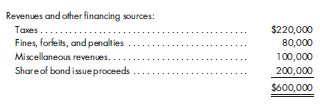

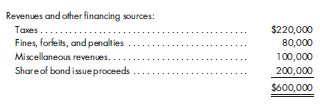

a. Budget adopted:

h. A taxpayer overpaid 2019 taxes by $2,000. (The taxes were credited to miscellaneous revenue upon receipt.) The taxpayer applied for a $2,000 credit against 2020 taxes. The city council granted the request. The council instructed the city controller to adjust the estimated uncollectible current taxes to cover the remaining uncollected balance.

i. Vouchers paid amounted to $580,000.

j. Inventory on December 31, 2019, amounted to $12,000.

Using control accounts, prepare journal entries to record the foregoing data. Omit explanations.

The following data pertain to 2019 general fund operations:

a. Budget adopted:

h. A taxpayer overpaid 2019 taxes by $2,000. (The taxes were credited to miscellaneous revenue upon receipt.) The taxpayer applied for a $2,000 credit against 2020 taxes. The city council granted the request. The council instructed the city controller to adjust the estimated uncollectible current taxes to cover the remaining uncollected balance.

i. Vouchers paid amounted to $580,000.

j. Inventory on December 31, 2019, amounted to $12,000.

Using control accounts, prepare journal entries to record the foregoing data. Omit explanations.

Explanation

b) • Encumbrance account is transferred...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255