Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 4

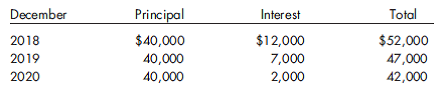

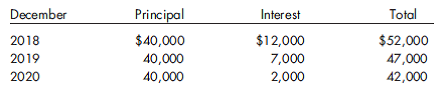

Journal entries, leases. Mack County has acquired equipment through a noncancelable lease-purchase agreement dated December 31, 2017. This agreement requires no down payment and the following minimum lease payments:

1. What account should be debited for $120,000 in the general fund at inception of the lease if the equipment is a general fixed asset andMack does not use a capital projects fund?

2. What account should be credited for $120,000 in the general fixed assets account group at inception of the lease if the equipment is a general fixed asset?

3. What journal entry is required for $120,000 in the general long-term debt account group at inception of the lease if the lease payments are to be financed with general government resources?

1. What account should be debited for $120,000 in the general fund at inception of the lease if the equipment is a general fixed asset andMack does not use a capital projects fund?

2. What account should be credited for $120,000 in the general fixed assets account group at inception of the lease if the equipment is a general fixed asset?

3. What journal entry is required for $120,000 in the general long-term debt account group at inception of the lease if the lease payments are to be financed with general government resources?

Explanation

1. Country M does not use the capital pr...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255