Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 25

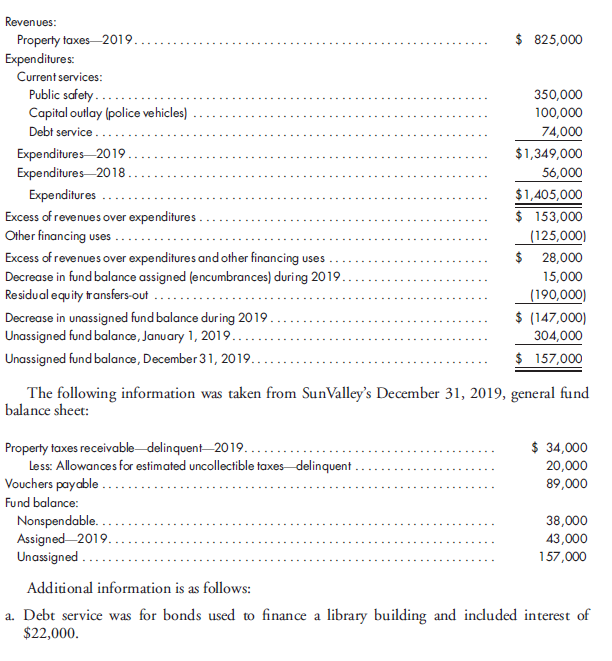

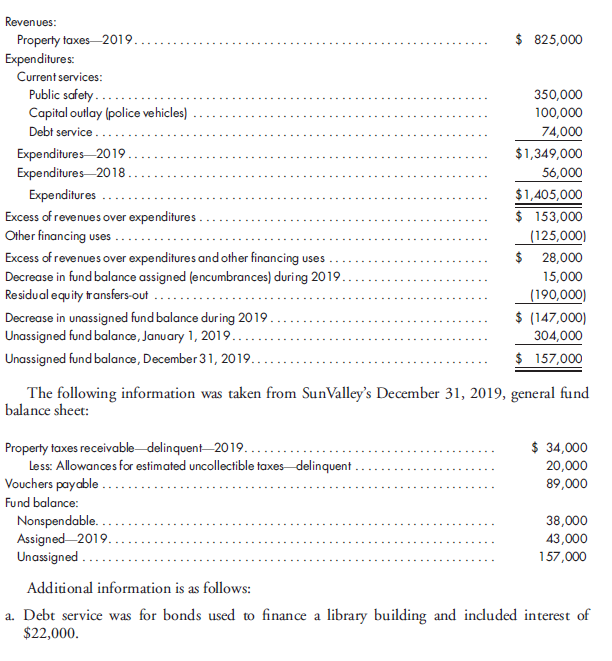

Financial statements. The following selected information was taken from SunValley City's general fund statement of revenues, expenditures, and changes in fund balance for the year ended December 31, 2019:

b. $8,000 of 2019 property taxes receivable was written off; otherwise, the allowance for uncollectible taxes balance is unchanged from the initial entry at the time of the original tax levy at the beginning of the year.

c. SunValley reported supplies inventory of $21,000 at December 31, 2018.

Provide the best answer to the following questions:

1. What recording method did SunValley use for its general fund supplies inventory?

2. What amount was collected from 2019 tax assessments?

3. What amount is SunValley's liability to general fund vendors and contractors at December 31, 2019?

4. What amount should be included in the general fixed assets account group for the cost of assets acquired in 2019 through the general fund?

5. What amount arising from 2019 transactions decreased liabilities reported in the general long-term debt account group?

6. What amount of total actual expenditures should SunValley report in its 2019 general fund statement of revenues, expenditures, and changes in fund balance-budget and actual?

b. $8,000 of 2019 property taxes receivable was written off; otherwise, the allowance for uncollectible taxes balance is unchanged from the initial entry at the time of the original tax levy at the beginning of the year.

c. SunValley reported supplies inventory of $21,000 at December 31, 2018.

Provide the best answer to the following questions:

1. What recording method did SunValley use for its general fund supplies inventory?

2. What amount was collected from 2019 tax assessments?

3. What amount is SunValley's liability to general fund vendors and contractors at December 31, 2019?

4. What amount should be included in the general fixed assets account group for the cost of assets acquired in 2019 through the general fund?

5. What amount arising from 2019 transactions decreased liabilities reported in the general long-term debt account group?

6. What amount of total actual expenditures should SunValley report in its 2019 general fund statement of revenues, expenditures, and changes in fund balance-budget and actual?

Explanation

2.

Amount collected from 2019 tax asses...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255