Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 1

Various funds and account groups. Select the best response for each of the following multiple-choice questions. (Nos. 1-8 are AICPA adapted.)

1. In 2019, a state government collected income taxes of $8,000,000 for the benefit of one of its cities that imposes an income tax on its residents. The state periodically remitted these collections to the city. The state should account for the $8,000,000 in the

a. general fund.

b. agency funds.

c. internal service funds.

d. special assessment funds.

2. Kew City received a $15,000,000 federal grant to finance the construction of a center for rehabilitation of drug addicts. The proceeds of this grant should be accounted for in the

a. special revenue funds.

b. general fund.

c. capital projects funds.

d. trust funds.

3. Lisa County issued $5,000,000 of general obligation bonds at 101 to finance a capital project. The $50,000 premium was to be used for payment of interest. The transactions involving the premium should be accounted for in the

a. capital projects funds, the debt service funds, and the general long-termdebt account group.

b. capital projects funds and debt service funds only.

c. debt service funds and the general long-term debt account group only.

d. debt service funds only.

4. Oak Township issued the following bonds during the year ended June 30, 2011:

What amount of these bonds should be accounted for in Oak's general long-term debt account group?

a. $0

b. $350,000

c. $500,000

d. $850,000

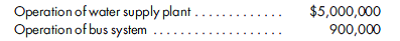

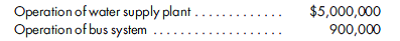

5. During 2019, Walnut City reported the following receipts from self-sustaining activities paid for by users of the services rendered:

What amount should be accounted for inWalnut's enterprise funds?

a. $0

b. $900,000

c. $5,000,000

d. $5,900,000

6. Through an internal service fund, Maple County operates a centralized data-processing center to provide services to Maple's other governmental units. In 2019, this internal service fund billed Maple's Parks and Recreation Fund $25,000 for data-processing services. What account should Maple's internal service fund credit to record this $25,000 billing to the Parks and Recreation Fund?

a. Operating Revenues

b. Interfund Exchanges

c. Intergovernmental Transfers

d. Data-Processing Department Expenses

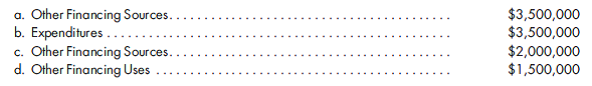

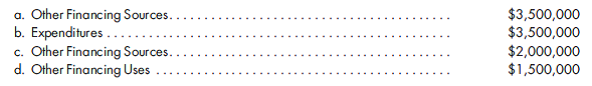

7. On December 31, 2019, Lilly Village paid a contractor $3,500,000 for the total cost of a new

Village Hall built in 2019 on Lilly-owned land. Financing for the capital project was provided by a $2,000,000 general obligation bond issue sold at face amount on December 31, 2019, with the remaining $1,500,000 transferred from the general fund. What account and amount should be reported in Lilly's 2019 fund financial statements for the general fund?

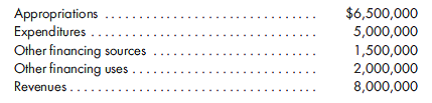

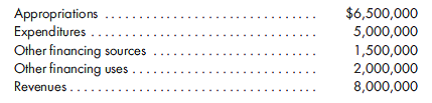

8. The following information pertains to Pinehurst City's special revenue fund in 2019:

After Pinehurst's general fund accounts were closed at the end of 2019, the fund balance increased by

1. In 2019, a state government collected income taxes of $8,000,000 for the benefit of one of its cities that imposes an income tax on its residents. The state periodically remitted these collections to the city. The state should account for the $8,000,000 in the

a. general fund.

b. agency funds.

c. internal service funds.

d. special assessment funds.

2. Kew City received a $15,000,000 federal grant to finance the construction of a center for rehabilitation of drug addicts. The proceeds of this grant should be accounted for in the

a. special revenue funds.

b. general fund.

c. capital projects funds.

d. trust funds.

3. Lisa County issued $5,000,000 of general obligation bonds at 101 to finance a capital project. The $50,000 premium was to be used for payment of interest. The transactions involving the premium should be accounted for in the

a. capital projects funds, the debt service funds, and the general long-termdebt account group.

b. capital projects funds and debt service funds only.

c. debt service funds and the general long-term debt account group only.

d. debt service funds only.

4. Oak Township issued the following bonds during the year ended June 30, 2011:

What amount of these bonds should be accounted for in Oak's general long-term debt account group?

a. $0

b. $350,000

c. $500,000

d. $850,000

5. During 2019, Walnut City reported the following receipts from self-sustaining activities paid for by users of the services rendered:

What amount should be accounted for inWalnut's enterprise funds?

a. $0

b. $900,000

c. $5,000,000

d. $5,900,000

6. Through an internal service fund, Maple County operates a centralized data-processing center to provide services to Maple's other governmental units. In 2019, this internal service fund billed Maple's Parks and Recreation Fund $25,000 for data-processing services. What account should Maple's internal service fund credit to record this $25,000 billing to the Parks and Recreation Fund?

a. Operating Revenues

b. Interfund Exchanges

c. Intergovernmental Transfers

d. Data-Processing Department Expenses

7. On December 31, 2019, Lilly Village paid a contractor $3,500,000 for the total cost of a new

Village Hall built in 2019 on Lilly-owned land. Financing for the capital project was provided by a $2,000,000 general obligation bond issue sold at face amount on December 31, 2019, with the remaining $1,500,000 transferred from the general fund. What account and amount should be reported in Lilly's 2019 fund financial statements for the general fund?

8. The following information pertains to Pinehurst City's special revenue fund in 2019:

After Pinehurst's general fund accounts were closed at the end of 2019, the fund balance increased by

Explanation

In agency fund accounting, state laws gr...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255