Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 42

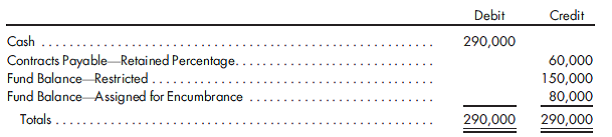

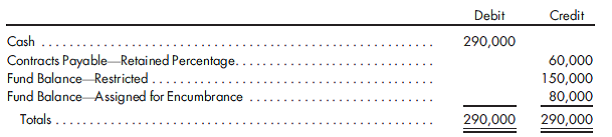

Special assessments, capital projects fund, debt service fund, effect on other funds/groups. You are given the following post-closing trial balance for the Special Assessment Capital Projects Fund of the city of StoneCreek Bank as of January 1, 2018. The project was started last year and should be completed in June of 2018.

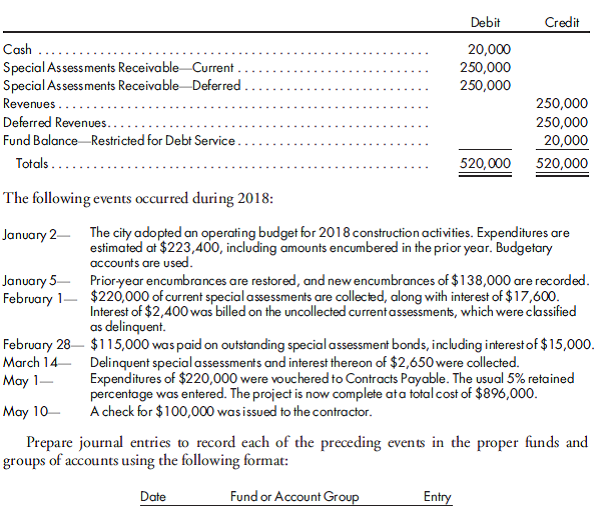

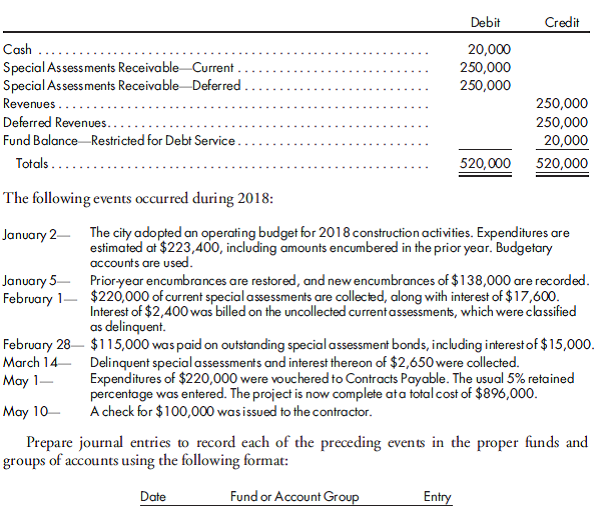

The special assessments are collected by the debt service fund, which also makes payments of principal and interest on special assessment bonds. The city has guaranteed payment of the debt in the event of nonpayment by the special assessment property owners. The debt service fund has the following balances, shown on page 880, on January 1, 2018.

The special assessments are collected by the debt service fund, which also makes payments of principal and interest on special assessment bonds. The city has guaranteed payment of the debt in the event of nonpayment by the special assessment property owners. The debt service fund has the following balances, shown on page 880, on January 1, 2018.

Explanation

Journal entry in the books of capital pr...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255