Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 3

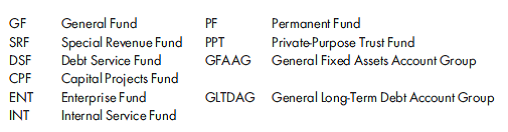

Impact of transactions on different funds. Indicate into which fund a city would record each of the following transactions. (You need not make any entries.)

a. Fixed assets are purchased with general fund cash.

b. Long-term serial bonds are issued to finance the construction of a new art museum. The bonds are sold at a premium.

c. The general fund transfers a sufficient amount of money to cover principal and interest requirements of a debt issue.

d. The fund receiving the payment in item (c) makes the scheduled payment of principal and interest.

e. A special assessment project is one-half completed at year-end.

f. Income is earned by an endowment fund and is transferred to a recipient fund, which is restricted as to its expenditures by the trust agreement specified for a government program.

g. Possible depreciation entries on assets are recorded.

h. The government-owned water utility issues debt to purchase new equipment.

i. The new city prison is completed, and leftover funds are transferred to the fund responsible for repaying the debt used to finance the project.

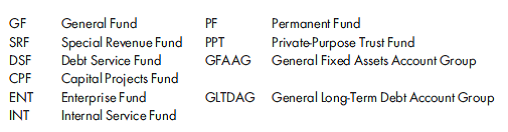

a. Fixed assets are purchased with general fund cash.

b. Long-term serial bonds are issued to finance the construction of a new art museum. The bonds are sold at a premium.

c. The general fund transfers a sufficient amount of money to cover principal and interest requirements of a debt issue.

d. The fund receiving the payment in item (c) makes the scheduled payment of principal and interest.

e. A special assessment project is one-half completed at year-end.

f. Income is earned by an endowment fund and is transferred to a recipient fund, which is restricted as to its expenditures by the trust agreement specified for a government program.

g. Possible depreciation entries on assets are recorded.

h. The government-owned water utility issues debt to purchase new equipment.

i. The new city prison is completed, and leftover funds are transferred to the fund responsible for repaying the debt used to finance the project.

Explanation

b)Transaction:

Long-term serial bonds a...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255