Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 6

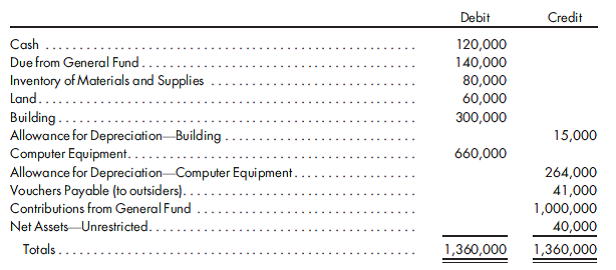

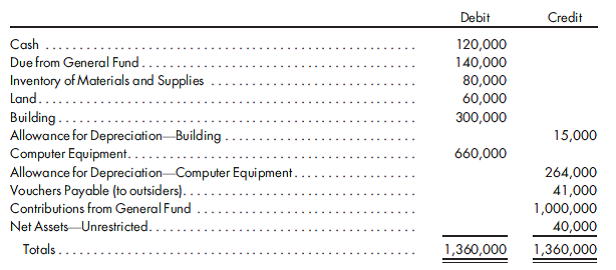

Internal service fund. The city of Cloverville operates a central computer center through an internal service fund. The Computer Internal Service Fund was established by a contribution of $1,000,000 from the general fund on July 1, 2017, at which time a building was acquired at a cost of $300,000 cash. A used computer was purchased for $600,000. The post-closing trial balance of the fund at June 30, 2018, was as follows:

The following information applies to the year ended June 30, 2019:

a. Materials and supplies were purchased on account for $72,000.

b. The inventory of materials and supplies at June 30, 2019, was $65,000.

c. Salaries paid totaled $235,000, including related costs.

d. A billing from the Utility Enterprise Fund for $40,000 was received and paid.

e. Depreciation on the building and on the equipment was $6,500 and $133,000, respectively.

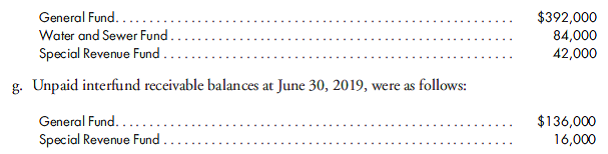

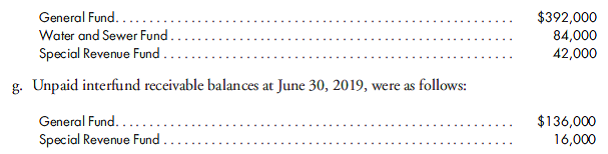

f. Billings to other departments for service were as follows:

h. Vouchers payable at June 30, 2019, were $19,000.

1. For the period July 1, 2018, through June 30, 2019, prepare journal entries to record the transactions in the Computer Internal Service Fund. The city uses control accounts for revenues and expenses.

2. Prepare closing entries at June 30, 2019. Note: All net assets are designated unrestricted.

The following information applies to the year ended June 30, 2019:

a. Materials and supplies were purchased on account for $72,000.

b. The inventory of materials and supplies at June 30, 2019, was $65,000.

c. Salaries paid totaled $235,000, including related costs.

d. A billing from the Utility Enterprise Fund for $40,000 was received and paid.

e. Depreciation on the building and on the equipment was $6,500 and $133,000, respectively.

f. Billings to other departments for service were as follows:

h. Vouchers payable at June 30, 2019, were $19,000.

1. For the period July 1, 2018, through June 30, 2019, prepare journal entries to record the transactions in the Computer Internal Service Fund. The city uses control accounts for revenues and expenses.

2. Prepare closing entries at June 30, 2019. Note: All net assets are designated unrestricted.

Explanation

• Journal entry for maintaining of inven...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255