Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 27

Various funds and account groups. The following information relates to Carson City during its fiscal year ended December 31, 2019:

a. On October 31, 2019, to finance the construction of a city hall annex, Carson issued 8%, 10-year general obligation bonds at their face value of $600,000. Construction expenditures during the period equaled $364,000.

b. Carson reported $109,000 from hotel room taxes, restricted for tourist promotion, in a special revenue fund. The fund paid $81,000 for general promotions and $22,000 for a motor vehicle.

c. 2019 general fund revenues of $104,500 were transferred to a debt service fund and used to repay $100,000 of 9%, 15-year term bonds and $4,500 of interest. The bonds were used to acquire a citizens' center.

d. At December 31, 2019, as a consequence of past services, city firefighters had accumulated entitlements to compensated absences valued at $86,000. General fund resources available at December 31, 2019, are expected to be used to settle $17,000 of this amount, and $69,000 is expected to be paid out of future general fund resources.

e. At December 31, 2019, Carson was responsible for $83,000 of outstanding general fund encumbrances, including $8,000 for the following supplies.

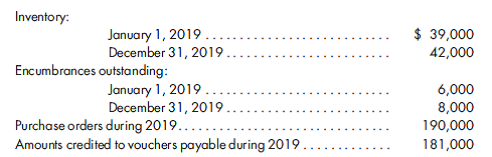

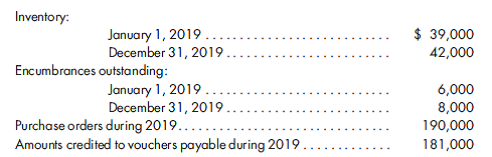

f. Carson uses the purchases method to account for supplies. The following information relates to supplies:

1. The amount of 2019 general fund operating transfers-out is ________________.

2. The 2019 general fund liabilities from entitlements for compensated absences are ________________.

3. The 2019 reserved amount of the general fund balance is ________________.

4. The 2019 capital projects fund balance is ________________.

5. The 2019 fund balance on the special revenue fund for tourist promotion is ________________.

6. The amount of 2019 debt service fund expenditures is ________________.

7. The amount to be included in the general fixed assets account group for the cost of assets acquired in 2019 is _______________.

8. The amount by which 2019 transactions and events decreased the general long-term debt account group is _______________.

9. The amount of 2019 supplies expenditures using the purchases method is ________________.

10. The total amount of 2019 supplies encumbrances is ________________.

a. On October 31, 2019, to finance the construction of a city hall annex, Carson issued 8%, 10-year general obligation bonds at their face value of $600,000. Construction expenditures during the period equaled $364,000.

b. Carson reported $109,000 from hotel room taxes, restricted for tourist promotion, in a special revenue fund. The fund paid $81,000 for general promotions and $22,000 for a motor vehicle.

c. 2019 general fund revenues of $104,500 were transferred to a debt service fund and used to repay $100,000 of 9%, 15-year term bonds and $4,500 of interest. The bonds were used to acquire a citizens' center.

d. At December 31, 2019, as a consequence of past services, city firefighters had accumulated entitlements to compensated absences valued at $86,000. General fund resources available at December 31, 2019, are expected to be used to settle $17,000 of this amount, and $69,000 is expected to be paid out of future general fund resources.

e. At December 31, 2019, Carson was responsible for $83,000 of outstanding general fund encumbrances, including $8,000 for the following supplies.

f. Carson uses the purchases method to account for supplies. The following information relates to supplies:

1. The amount of 2019 general fund operating transfers-out is ________________.

2. The 2019 general fund liabilities from entitlements for compensated absences are ________________.

3. The 2019 reserved amount of the general fund balance is ________________.

4. The 2019 capital projects fund balance is ________________.

5. The 2019 fund balance on the special revenue fund for tourist promotion is ________________.

6. The amount of 2019 debt service fund expenditures is ________________.

7. The amount to be included in the general fixed assets account group for the cost of assets acquired in 2019 is _______________.

8. The amount by which 2019 transactions and events decreased the general long-term debt account group is _______________.

9. The amount of 2019 supplies expenditures using the purchases method is ________________.

10. The total amount of 2019 supplies encumbrances is ________________.

Explanation

Fiscal Year

A fiscal year can be define...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255