Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 4

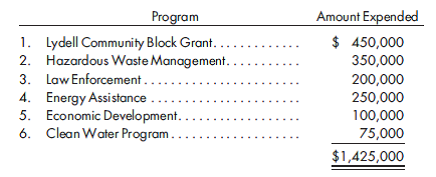

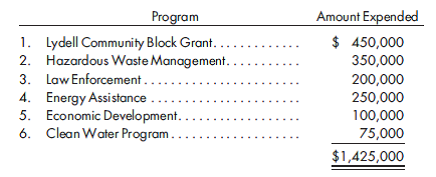

Audit concerns. The city of Lydell expended federal awards from the following programs during 2019.

Assume the auditor has given an unqualified opinion on the financial statements and reports no material weaknesses or reportable conditions in internal control at the financial statement level. Also, assume the auditor has given an unqualified opinion on the schedule of expenditures of federal awards. Programs 2 and 4 are classified as low risk, and Program 6 was not assessed for risk due to its small size.

1. Which programs should the auditor audit as major programs for the purpose of internal control evaluation and compliance testing for the year 2019?

2. How would your answer differ if Program 2 was classified as high risk?

Assume the auditor has given an unqualified opinion on the financial statements and reports no material weaknesses or reportable conditions in internal control at the financial statement level. Also, assume the auditor has given an unqualified opinion on the schedule of expenditures of federal awards. Programs 2 and 4 are classified as low risk, and Program 6 was not assessed for risk due to its small size.

1. Which programs should the auditor audit as major programs for the purpose of internal control evaluation and compliance testing for the year 2019?

2. How would your answer differ if Program 2 was classified as high risk?

Explanation

Required :

The programs an auditor audit...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255