Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 3

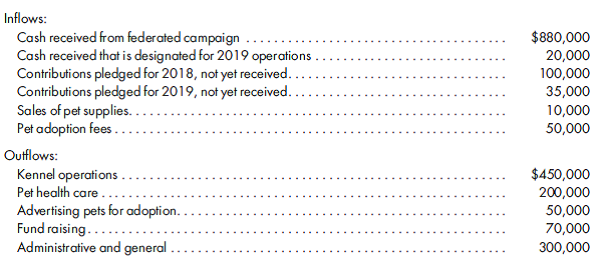

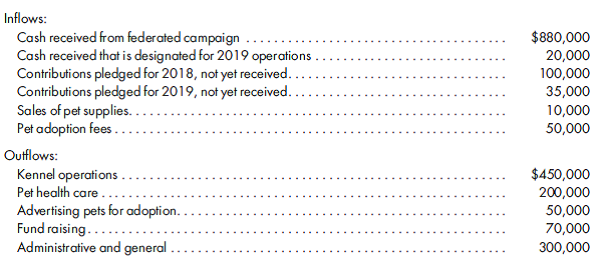

VHWO, accounting and reporting. Select the best answer for each of the following multiple-choice items. Items (1) through (3) are based on the following: The Bayview Humane Society, a VHWO caring for lost animals, had the following financial inflows and outflows for the year ended December 31, 2018:

1. In the humane society's statement of activities for the year ended December 31, 2018, what amount should be reported under the classification of program services expense?

a. $770,000

b. $700,000

c. $550,000

d. $500,000

2. In the humane society's statement of activities for the year ended December 31, 2018, what amount should be reported under the classification of public support-unrestricted?

a. $740,000

b. $762,000

c. $980,000

d. $825,000

3. In the humane society's balance sheet as of December 31, 2018, what amount should be reported under the classification of public support-temporarily restricted?

a. $55,000

b. $30,000

c. $25,000

d. $0

4. Apex, Inc., donated a computer to Bird Shelter, a voluntary welfare organization. The computer cost Apex $40,000. On the date of donation, it had a book value of $25,000 and a fair value of $20,000. Bird Shelter's depreciation expense should be based on

a. $40,000.

b. $25,000.

c. $20,000.

d. $15,000.

5. Safe Haven, a voluntary welfare organization funded by contributions from the general public, received unrestricted pledges of $400,000 during 2018. It was estimated that 12% of these pledges would be uncollectible. By the end of 2018, $300,000 of the pledges had been collected, and it was expected that $40,000 more would be collected in 2019, with the balance of $60,000 to be written off as uncollectible. Donors did not specify any periods during which the donations were to be used. What amount should Safe Haven include under public support in 2018 for contributions?

a. $400,000

b. $352,000

c. $340,000

d. $300,000

6. The following expenditures were among those incurred by a voluntary welfare organization during 2019:

Printing of annual report.................................................. $10,000

Unsolicited merchandise sent to encourage contributions......................... 20,000

What amount should be classified as fund-raising costs in the society's statement of activities?

a. $0

b. $10,000

c. $20,000

d. $30,000

1. In the humane society's statement of activities for the year ended December 31, 2018, what amount should be reported under the classification of program services expense?

a. $770,000

b. $700,000

c. $550,000

d. $500,000

2. In the humane society's statement of activities for the year ended December 31, 2018, what amount should be reported under the classification of public support-unrestricted?

a. $740,000

b. $762,000

c. $980,000

d. $825,000

3. In the humane society's balance sheet as of December 31, 2018, what amount should be reported under the classification of public support-temporarily restricted?

a. $55,000

b. $30,000

c. $25,000

d. $0

4. Apex, Inc., donated a computer to Bird Shelter, a voluntary welfare organization. The computer cost Apex $40,000. On the date of donation, it had a book value of $25,000 and a fair value of $20,000. Bird Shelter's depreciation expense should be based on

a. $40,000.

b. $25,000.

c. $20,000.

d. $15,000.

5. Safe Haven, a voluntary welfare organization funded by contributions from the general public, received unrestricted pledges of $400,000 during 2018. It was estimated that 12% of these pledges would be uncollectible. By the end of 2018, $300,000 of the pledges had been collected, and it was expected that $40,000 more would be collected in 2019, with the balance of $60,000 to be written off as uncollectible. Donors did not specify any periods during which the donations were to be used. What amount should Safe Haven include under public support in 2018 for contributions?

a. $400,000

b. $352,000

c. $340,000

d. $300,000

6. The following expenditures were among those incurred by a voluntary welfare organization during 2019:

Printing of annual report.................................................. $10,000

Unsolicited merchandise sent to encourage contributions......................... 20,000

What amount should be classified as fund-raising costs in the society's statement of activities?

a. $0

b. $10,000

c. $20,000

d. $30,000

Explanation

2. (c) In the H society's statement of a...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255