Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 9

Preparation of a charge and discharge statement. Eleanor Matsun died on June 1 of the current year, leaving a valid will with JamesMadison being named as her personal representative. All of the following occurred in the year of her death:

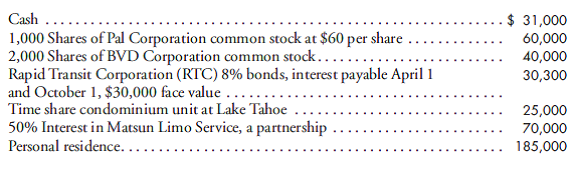

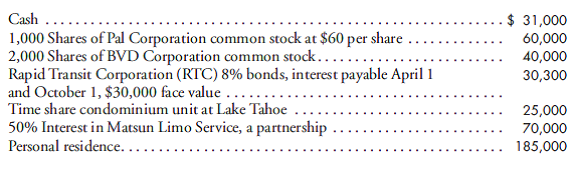

a. The personal representative prepared the following inventory of assets at fair market value as of the date of death:.

b. Subsequent to filing the above inventory with the court, the personal representative discovered the decedent's gold coin collection valued at $18,000.

c. On June 20, $2,500 was received from Pal Corporation for dividends declared onMay 10 to shareholders of record on May 31.

d. On July 7, the time share condominium was sold for $30,000.

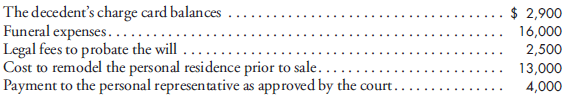

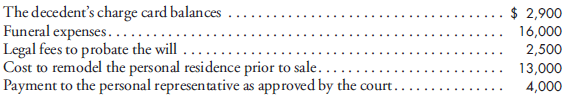

e. The following items were paid during the period from June 2 through July 31:

f. On July 5, a check for $15,000 was received for the decedent's portion of Matsun Limo Service income earned during the quarter ended June 30. Income is assumed to be earned evenly over the quarter.

g. The decedent's partner in the limo service offered the personal representative $65,000 for the decedent's interest in the partnership. After much negotiation, the interest was sold for $80,000.

h. In mid-September, the decedent's personal residence was sold for $162,000, net of brokerage and closing costs totaling $15,000. The outstanding mortgage and accrued interest were promptly paid in the amount of $82,800. At the date of death, the mortgage balance along with accrued interest was $81,100.

i. On October 1, a check was received for interest on the RTC bonds.

j. On November 5, the decedent's income tax return for the year of death was filed and $6,400 of additional taxes was sent in with the return.

Prepare a charge and discharge statement as of December 31 of the current year.

a. The personal representative prepared the following inventory of assets at fair market value as of the date of death:.

b. Subsequent to filing the above inventory with the court, the personal representative discovered the decedent's gold coin collection valued at $18,000.

c. On June 20, $2,500 was received from Pal Corporation for dividends declared onMay 10 to shareholders of record on May 31.

d. On July 7, the time share condominium was sold for $30,000.

e. The following items were paid during the period from June 2 through July 31:

f. On July 5, a check for $15,000 was received for the decedent's portion of Matsun Limo Service income earned during the quarter ended June 30. Income is assumed to be earned evenly over the quarter.

g. The decedent's partner in the limo service offered the personal representative $65,000 for the decedent's interest in the partnership. After much negotiation, the interest was sold for $80,000.

h. In mid-September, the decedent's personal residence was sold for $162,000, net of brokerage and closing costs totaling $15,000. The outstanding mortgage and accrued interest were promptly paid in the amount of $82,800. At the date of death, the mortgage balance along with accrued interest was $81,100.

i. On October 1, a check was received for interest on the RTC bonds.

j. On November 5, the decedent's income tax return for the year of death was filed and $6,400 of additional taxes was sent in with the return.

Prepare a charge and discharge statement as of December 31 of the current year.

Explanation

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255