Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 7

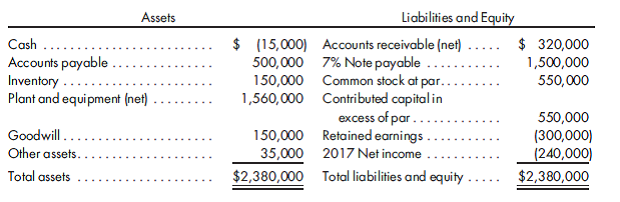

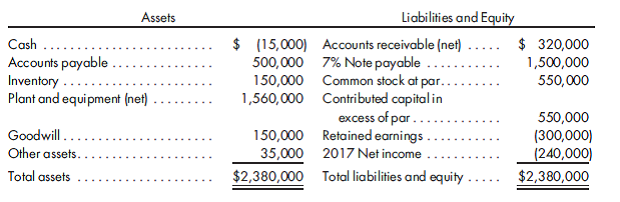

Effect of a quasi-reorganization. Marshall Tool and Die Company has been experiencing significant foreign competition and a declining market. Annual net losses from operations have averaged $250,000 over the last three years. The company's balance sheet as of December 31, 2017, is as follows:

After analyzing accounts receivable and inventory, it has been determined that the allowance for uncollectibles should be increased by $75,000 and the inventory should be written down by $20,000. Based on recent appraisals, it is estimated that the plant and equipment have a market value of $1,285,000. The goodwill is traceable to the purchase of a small tooling company in 2013. Based on an analysis of cash flows associated with that acquisition, it is estimated that the goodwill has an impaired value of $0. Other assets represent a note receivable from officers of the corporation. The note calls for five annual payments of $8,309 including interest at the rate of 6%.

In response to the current situation, the company has decided to take the following actions:

a. Record the suggested impairment in all assets.

b. Restructure the note receivable from the officers to reflect four annual payments and an interest rate of 7.5%.

c. Restructure the note payable, which was due in 2019, to provide for 12 semiannual payments of $120,000 including interest at the annual rate of 6%.

d. Engage in a quasi-reorganization to eliminate the deficit in retained earnings.

1. Prepare a revised classified balance sheet to reflect the effect of management's actions.

2. Compute the following ratios before and after management's actions: current ratio and debt-to-equity ratio.

3. Given the above ratio analysis, if the ratios do not suggest an improvement, discuss the benefits of management's actions.

After analyzing accounts receivable and inventory, it has been determined that the allowance for uncollectibles should be increased by $75,000 and the inventory should be written down by $20,000. Based on recent appraisals, it is estimated that the plant and equipment have a market value of $1,285,000. The goodwill is traceable to the purchase of a small tooling company in 2013. Based on an analysis of cash flows associated with that acquisition, it is estimated that the goodwill has an impaired value of $0. Other assets represent a note receivable from officers of the corporation. The note calls for five annual payments of $8,309 including interest at the rate of 6%.

In response to the current situation, the company has decided to take the following actions:

a. Record the suggested impairment in all assets.

b. Restructure the note receivable from the officers to reflect four annual payments and an interest rate of 7.5%.

c. Restructure the note payable, which was due in 2019, to provide for 12 semiannual payments of $120,000 including interest at the annual rate of 6%.

d. Engage in a quasi-reorganization to eliminate the deficit in retained earnings.

1. Prepare a revised classified balance sheet to reflect the effect of management's actions.

2. Compute the following ratios before and after management's actions: current ratio and debt-to-equity ratio.

3. Given the above ratio analysis, if the ratios do not suggest an improvement, discuss the benefits of management's actions.

Explanation

1.

The following is the revised classifi...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255