Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 2

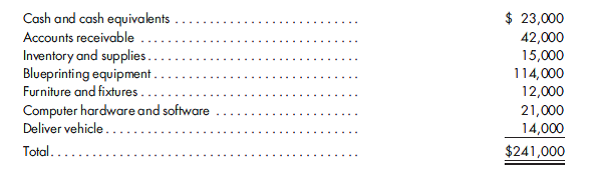

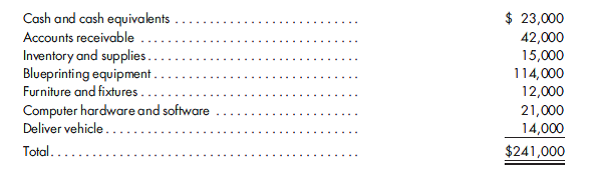

Amounts to be received by creditors under Chapter 7. Casper Blueprinting, Inc., has filed under Chapter 7 of the Bankruptcy Code. The estimated net realizable value of its assets is as follows:

Creditors' claims are summarized as follows:

a. Bank loan balance of $82,000 plus accrued interest of $3,000 with a first lien against blueprinting equipment.

b. Dealer-financed vehicle loan with an outstanding balance of $18,000, which is secured by the delivery vehicle.

c. Accounts payable due vendors in the amount of $21,000 and secured by the inventory and supplies.

d. A line of credit balance due of $30,000 secured by the accounts receivable.

e. Unpaid payroll and income taxes of $23,000.

f. Accounting and legal fees due in the amount of $12,000 in connection with the administration of the bankrupt estate.

g. Unpaid wages to employees totaling $4,200 ($700 represents the largest amount due any one employee).

h. Loans due shareholders of the corporation totaling $80,000.

i. Other unsecured creditors without priority in the amount of $31,000.

Prepare a schedule to show the estimated amount to be received by each major category of creditor.

Creditors' claims are summarized as follows:

a. Bank loan balance of $82,000 plus accrued interest of $3,000 with a first lien against blueprinting equipment.

b. Dealer-financed vehicle loan with an outstanding balance of $18,000, which is secured by the delivery vehicle.

c. Accounts payable due vendors in the amount of $21,000 and secured by the inventory and supplies.

d. A line of credit balance due of $30,000 secured by the accounts receivable.

e. Unpaid payroll and income taxes of $23,000.

f. Accounting and legal fees due in the amount of $12,000 in connection with the administration of the bankrupt estate.

g. Unpaid wages to employees totaling $4,200 ($700 represents the largest amount due any one employee).

h. Loans due shareholders of the corporation totaling $80,000.

i. Other unsecured creditors without priority in the amount of $31,000.

Prepare a schedule to show the estimated amount to be received by each major category of creditor.

Explanation

Prepare a schedule to show estimate amou...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255