Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 4

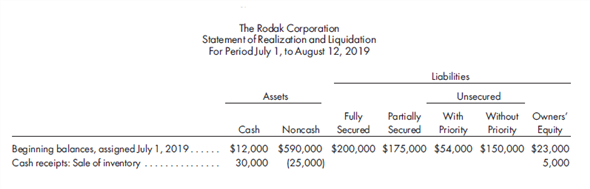

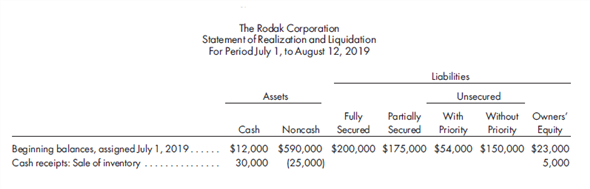

Statement of realization and liquidation, dividend to unsecured creditors without priority. A partially completed statement of realization and liquidation is as follows:

The following additional transactions have occurred through August 12, 2019:

a. Receivables collected amounted to $39,000. Receivables with a book value of $15,000 that were not allowed for were written off.

b. A $12,000 loan that was fully secured was paid off.

c. A valid claim was received from a leasing company seeking payment of $15,000 for equipment rentals.

d. Securities costing $18,000 were sold for $23,000, minus a brokerage fee of $500.

e. Depreciation on machinery was $3,200.

f. Payments on accounts payable totaled $25,000, of which the entire amount was secured by the inventory sold.

g. Machinery that originally cost $85,000 and had a book value of $45,000 sold for $36,000.

h. Proceeds from the sale of machinery in (g) were remitted to the bank, which holds a $50,000 loan on the machinery.

1. Update the statement of realization and liquidation to properly reflect transactions (a) through (h).

2. Assuming the remaining noncash assets can be realized for $410,000, determine the estimated dividend to be received by unsecured creditors without priority.

The following additional transactions have occurred through August 12, 2019:

a. Receivables collected amounted to $39,000. Receivables with a book value of $15,000 that were not allowed for were written off.

b. A $12,000 loan that was fully secured was paid off.

c. A valid claim was received from a leasing company seeking payment of $15,000 for equipment rentals.

d. Securities costing $18,000 were sold for $23,000, minus a brokerage fee of $500.

e. Depreciation on machinery was $3,200.

f. Payments on accounts payable totaled $25,000, of which the entire amount was secured by the inventory sold.

g. Machinery that originally cost $85,000 and had a book value of $45,000 sold for $36,000.

h. Proceeds from the sale of machinery in (g) were remitted to the bank, which holds a $50,000 loan on the machinery.

1. Update the statement of realization and liquidation to properly reflect transactions (a) through (h).

2. Assuming the remaining noncash assets can be realized for $410,000, determine the estimated dividend to be received by unsecured creditors without priority.

Explanation

Statement of Realization and Liquidation...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255