Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Edition 12ISBN: 978-1133189022

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Edition 12ISBN: 978-1133189022 Exercise 39

How Does Zillow.com Do It?

The website Zillow.com (founded in 2006) provides estimated values for practically every residential home in the United States. Because this amounts to more than 70 million homes, there is no way that the company can study the details of each house as a traditional real estate appraiser might. Instead, the company uses public data on homes that recently sold together with statistical techniques to estimate a relationship between the price of a house (P) and those characteristics of a house that can be obtained from public sources (such as the number of square feet, X).

A Simple Example For example, Zillow might determine that houses in a particular area obey the relationship:

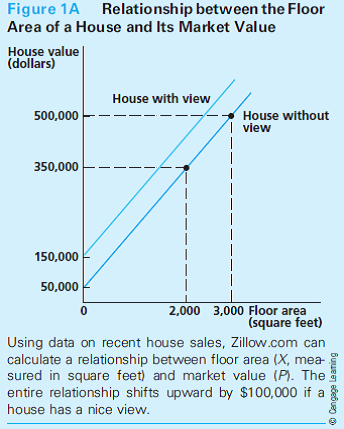

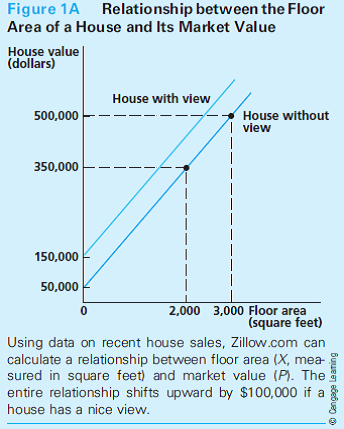

P = $50,000 + $150X (1)This equation says that a house in this location costs $50,000 (for the lot, say) plus $150 for each square foot. So, a 2,000 square foot house would be worth $350,000, and a 3,000 square foot house would be worth $500,000. Figure 1A shows this linear relationship. Using this relationship, Zillow can predict a value for every house in its database.

Location, Location, Location

One factor that Zillow must pay close attention to is the location of the houses it is pricing. As any real estate agent will tell you, location is often all that matters in a home price. Hence, it would not be appropriate to estimate a relationship such as Equation 1A.1 for the entire United States or even for a fairly large city. Instead, the firm must narrow its focus on localities where the square foot value of a house might reasonably be expected to be constant. In especially desirable locations, houses might sell for $500-$1,000 per square foot or more, and lots would cost much more than $50,000.

What Zillow Can't See

A second problem with the Zillow estimates is that actual house prices may depend on factors about which Zillow has no information. For example, real estate databases may have no information about whether a house has a nice view or not. If having a view would raise a typical lot price by $100,000, for example, the relationship for houses with views should be the one shown by the upper line in Figure 1A. Zillow would systematically underestimate the values of such houses.

How Accurate Is Zillow?

Zillow has been upfront in noting that their estimates may not be accurate and, in fact, their website regularly analyzes accuracy by comparing their estimates to actual sales prices. For late 2012, for example, their data show that typically about 30 percent of all sales are within 5 percent of their Zillow estimates and 80 percent are within 20 percent. Reported accuracy varies considerably across U.S. cities, in part because of differences in data availability. For example, the company reports that its estimates for Boston are usually quite accurate, whereas those for Miami show considerable errors.

Should Zillow eliminate from their calculations any house which seems to sell for an especially high price or an especially low price?

The website Zillow.com (founded in 2006) provides estimated values for practically every residential home in the United States. Because this amounts to more than 70 million homes, there is no way that the company can study the details of each house as a traditional real estate appraiser might. Instead, the company uses public data on homes that recently sold together with statistical techniques to estimate a relationship between the price of a house (P) and those characteristics of a house that can be obtained from public sources (such as the number of square feet, X).

A Simple Example For example, Zillow might determine that houses in a particular area obey the relationship:

P = $50,000 + $150X (1)This equation says that a house in this location costs $50,000 (for the lot, say) plus $150 for each square foot. So, a 2,000 square foot house would be worth $350,000, and a 3,000 square foot house would be worth $500,000. Figure 1A shows this linear relationship. Using this relationship, Zillow can predict a value for every house in its database.

Location, Location, Location

One factor that Zillow must pay close attention to is the location of the houses it is pricing. As any real estate agent will tell you, location is often all that matters in a home price. Hence, it would not be appropriate to estimate a relationship such as Equation 1A.1 for the entire United States or even for a fairly large city. Instead, the firm must narrow its focus on localities where the square foot value of a house might reasonably be expected to be constant. In especially desirable locations, houses might sell for $500-$1,000 per square foot or more, and lots would cost much more than $50,000.

What Zillow Can't See

A second problem with the Zillow estimates is that actual house prices may depend on factors about which Zillow has no information. For example, real estate databases may have no information about whether a house has a nice view or not. If having a view would raise a typical lot price by $100,000, for example, the relationship for houses with views should be the one shown by the upper line in Figure 1A. Zillow would systematically underestimate the values of such houses.

How Accurate Is Zillow?

Zillow has been upfront in noting that their estimates may not be accurate and, in fact, their website regularly analyzes accuracy by comparing their estimates to actual sales prices. For late 2012, for example, their data show that typically about 30 percent of all sales are within 5 percent of their Zillow estimates and 80 percent are within 20 percent. Reported accuracy varies considerably across U.S. cities, in part because of differences in data availability. For example, the company reports that its estimates for Boston are usually quite accurate, whereas those for Miami show considerable errors.

Should Zillow eliminate from their calculations any house which seems to sell for an especially high price or an especially low price?

Explanation

One of the problems faced by the analyst...

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255